Pharmaceutical Manufacturing Market by Molecule Type ,Drug Development Type & Recent Trends and Business Opportunities 2022-2032

The Global Pharmaceutical Manufacturing Market by Molecule Type (Biologics and Biosimilars (Large Molecules), Conventional Drugs (Small Molecules)), Drug Development Type (Outsource and In-house), Formulation (Tablets, Capsules, Injectables, Sprays, Suspensions, Powders and Other Formulations), Routes of Administration (Oral, Topical, Parenteral, Inhalations, Other Routes of administration), Therapy Area ( Cardiovascular Diseases, Pain ,Cancer, Diabetes , Respiratory Diseases, and Other Diseases), and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032

Market Size and Overview:

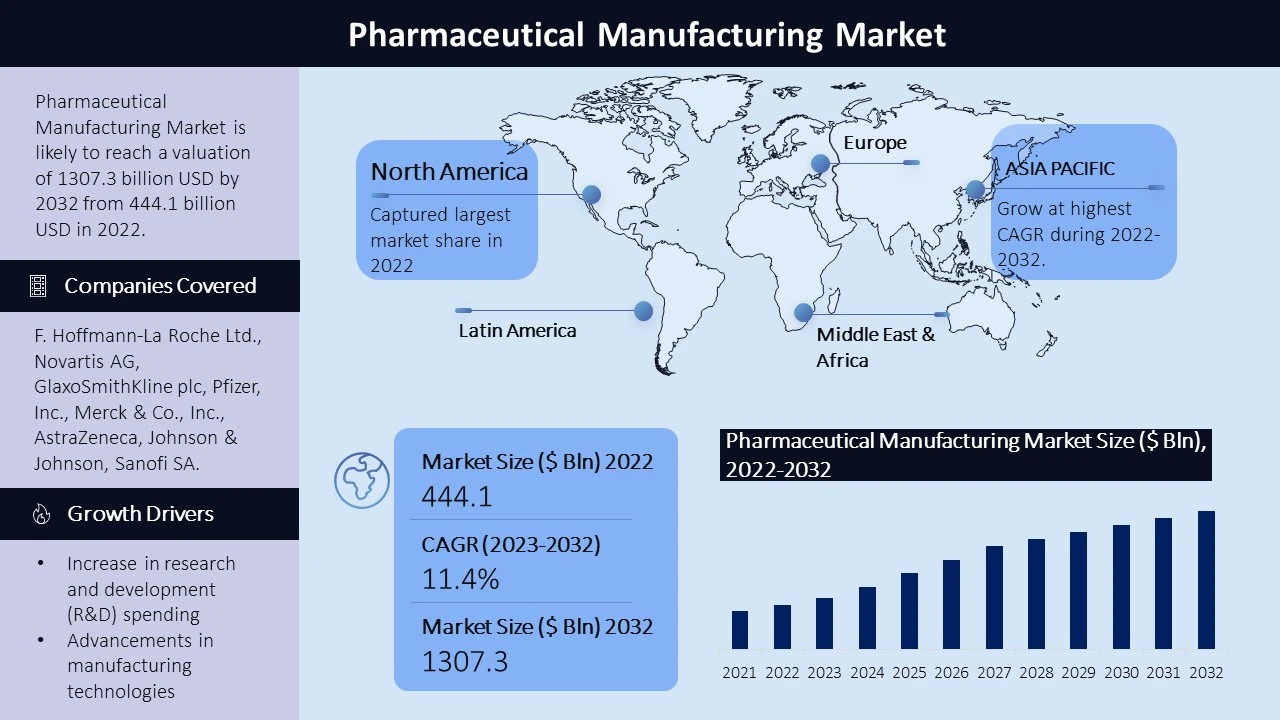

The pharmaceutical manufacturing market has experienced significant growth, with a compound annual growth rate (CAGR) of 11.4% from 2023 to 2032, reaching a market value of $1307.3 billion in 2032. This growth can be attributed to the increasing demand for pharmaceutical products worldwide, driven by factors such as population growth, aging demographics, and the prevalence of chronic diseases. Additionally, advancements in technology and the rising focus on research and development activities have further fueled the expansion of the pharmaceutical manufacturing market. The market encompasses various segments, including drug formulation, active pharmaceutical ingredients (APIs) manufacturing, and packaging. With intense competition, key players in the industry are continuously striving for innovation and process optimization to meet the evolving needs of healthcare providers and patients.

|

Pharmaceutical Manufacturing Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

11.4% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Market Segmentation:

Molecule Type:

- Biologics & Biosimilars (Large Molecules)

- Conventional Drugs (Small Molecules)

Drug Development Type:

- In-house

- Outsource

Formulation:

- Tablets

- Capsules

- Injectable

- Sprays

- Suspensions

- Powders

- Other Formulations

Routes of Administration:

- Oral

- Topical

- Parenteral

- Inhalations

- Other Routes of Administration

Therapy Area:

- Cardiovascular Diseases (CVDs)

- Pain

- Diabetes

- Cancer

- Respiratory Diseases

- Other Diseases

Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Biologics & Biosimilars (Large Molecules): The segment of biologics and biosimilars holds a significant market share in the pharmaceutical manufacturing market. These large molecule drugs, derived from living organisms, have shown tremendous potential in treating various diseases, including cancer, autoimmune disorders, and genetic conditions. The demand for biologics and biosimilars is driven by the increasing prevalence of complex diseases and the advancements in biotechnology and genetic engineering.

In-house Drug Development: In-house drug development represents a major segment of the pharmaceutical manufacturing market. Pharmaceutical companies invest in research and development activities to discover and develop new drugs and therapies. The in-house approach allows companies to have greater control over the entire drug development process, from discovery to commercialization, enabling them to bring innovative treatments to market.

Regional Analysis:

The regional analysis of the pharmaceutical manufacturing market reveals diverse trends and dynamics across different parts of the world. Starting with North America, this region boasts one of the largest pharmaceutical markets, primarily driven by the United States. The presence of well-established pharmaceutical companies, strong healthcare infrastructure, and a favorable regulatory environment contributes to the market's dominance. In Europe, countries like Germany, France, and the United Kingdom hold significant market shares, with a focus on research and development, advanced manufacturing capabilities, and stringent quality standards. The Asia Pacific region exhibits rapid growth, propelled by factors such as population growth, increasing healthcare spending, and a rise in chronic diseases. Countries like China, India, and Japan play a pivotal role in the growth of the pharmaceutical manufacturing market in this region. Latin America demonstrates steady growth, driven by improving healthcare infrastructure, rising disposable incomes, and a growing demand for affordable medications. Brazil, Mexico, and Argentina are key markets within the region. Lastly, the Middle East and Africa exhibit a developing market, with a focus on improving healthcare access, strengthening regulatory frameworks, and expanding pharmaceutical manufacturing capabilities. The United Arab Emirates, Saudi Arabia, and South Africa are notable contributors to the market's growth in this region.

Growth Drivers:

Several factors contribute to the growth of the pharmaceutical manufacturing market. Firstly, there is an increase in pharmaceutical research and development (R&D) spending. Pharmaceutical companies are investing more in R&D to discover new drugs and develop innovative treatment solutions, which drives market growth.

Secondly, advancements in pharmaceutical manufacturing technologies play a significant role. The introduction of advanced manufacturing processes, such as continuous manufacturing and personalized medicine, improves efficiency, reduces costs, and enhances drug quality, driving market expansion.

The growing problem of chronic disorders and the rise in the geriatric population also drive market growth. As the global population ages and the incidence of chronic diseases increases, there is a higher demand for pharmaceutical products to treat and manage these conditions. This presents opportunities for pharmaceutical manufacturers to develop and supply medications for various therapeutic areas.

Additionally, the use of outsourcing by pharmaceutical companies for drug development contributes to market growth. Outsourcing allows companies to leverage specialized expertise and resources, reduce costs, and accelerate the drug development process. This trend is particularly prominent in contract manufacturing and contract research organizations, driving the growth of the pharmaceutical manufacturing market.

Challenges:

The pharmaceutical manufacturing market faces challenges such as stringent regulatory requirements, increasing pricing pressures, and the need for substantial investments in infrastructure and quality control. Additionally, intellectual property rights, drug counterfeit issues, and complex supply chain management pose challenges to the industry's growth and profitability.

Key Companies:

The pharmaceutical manufacturing market is dominated by several leading companies that play a pivotal role in the industry. These companies have established a strong market presence, possessed extensive distribution networks, and offered a wide range of pharmaceutical products. Some of the key companies in the market include F. Hoffmann-La Roche Ltd., Novartis AG, GlaxoSmithKline plc, Pfizer, Inc., Merck & Co., Inc., AstraZeneca, Johnson & Johnson, Sanofi SA, Eli Lilly and Company, AbbVie, Inc., Sun Pharmaceutical Industries Ltd., Novo Nordisk A/S, Takeda Pharmaceuticals, Inc., Cipla Limited, Bristol Myers Squibb Company, and Gilead Sciences, Inc. And other players.

In recent news, in April 2022, Recipharm made significant acquisitions by acquiring Arranta Bio and virotherapy CDMO Vibalogics. This move reflects Recipharm's strategy to strengthen its presence in the biologics market, particularly in the manufacturing of advanced therapy medicinal products (ATMPs).

Another notable development in the pharmaceutical manufacturing market occurred in February 2022, when Biocon Biologics Ltd (BBL), a subsidiary of Biocon, entered into a definitive agreement to acquire Viatris' biosimilars assets for USD 3.34 billion.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -