Medical Gases and Equipment Market By Type (Pure Medical Gases, Oxygen, Carbon Dioxide, Nitrogen, Nitrous Oxide, Medical Air, Helium, Medical Gas Mixtures, Blood-Gas Mixtures, Lung Diffusion Mixtures, Nitrous Oxide-Oxygen Mixtures, Carbon Dioxide-Oxygen Mixtures, Laser-Gas Mixtures, Ethylene Oxide/Sterilant Gas Mixtures, Others); By Application (Therapeutic Applications, Pharmaceutical Manufacturing & Research, Diagnostic Applications, Other Applications); By End User (Hospitals, Home Healthcare, Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Others); By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

Medical Gases and Equipment Market Insights

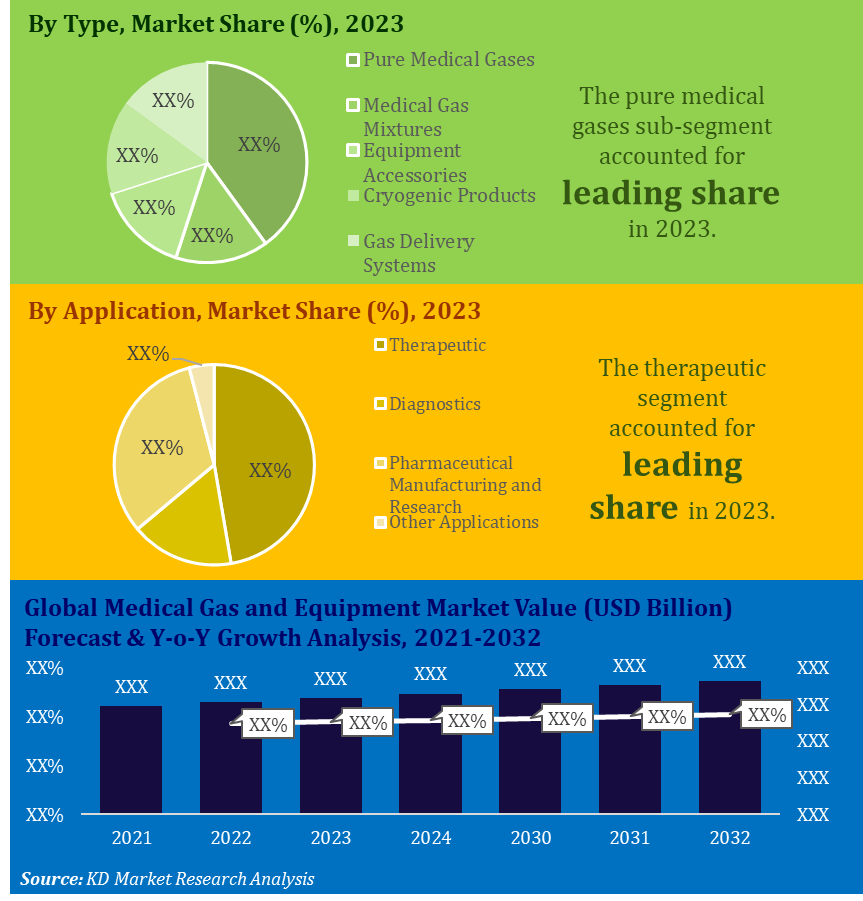

Global medical gas and equipment market accounted for USD 17,141.0 Million in 2022 and is estimated to reach USD 26,765.8 Billion in 2032, registering a compound annual growth rate (CAGR) of 8.8% between 2021 and 2032. Factors such as the soaring prevalence of chronic respiratory diseases among people as a result of the high frequency of tobacco use and the rising pollution levels, the surging incidence of preterm births and the proliferating count of geriatric population are driving the growth of global medical gas and equipment market.

The market is segmented by type into medical gas and medical gas equipment. The medical gas segment is further categorized in pure medical gases and medical gas mixtures, out of which, the pure medical gases segment shared approximately 24.5% of the global medical gas and equipment market in 2022. The pure medical gas sub-segment is further categorized among which, the oxygen sub sub-segment grabbed the major share in the market in 2022. The medical gas equipment is further categorized into equipment accessories, cryogenic products and gas delivery systems.

Based on application, the market is segmented into therapeutic, diagnostics, pharmaceutical manufacturing and research and others, out of which, the therapeutic segment account for the largest share in the market in 2022. Based on end-user, the hospitals segment accounted for the major share in 2022.

Growth Drivers of Medical Gas and Equipment Market

Rising Prevalence Of Chronic Diseases

Obesity is considered to be one of the major factors responsible for the burgeoning prevalence of chronic disorders, including diabetes and heart disorders. The number of people suffering from obesity and related disorders across the globe has multiplied significantly in the recent years due to major changes in lifestyle and eating habits of people. Medical gases form a critical component of a wide range of long-term care treatments for various chronic conditions, including chronic respiratory diseases, cardiovascular diseases and cancer. The increasing prevalence of chronic and lifestyle diseases is thus anticipated to significantly contribute towards the growth of the global medical gas and equipment market during the forecast period 2023-2032.

Increasing Technological Advancements

Technological advancements in the pharmaceutical industry have rapidly surged in the recent years. Major companies in the market are seen to be increasingly emphasizing on developing smaller and portable gas delivery systems that can be carried by patients. The development of advanced products including cheap, lightweight and portable medical gas handling equipment are aiding in the improvement of various healthcare services and are also increasing the number of functionality options in hospitals and home care. This increase in the number of technological innovations is anticipated to create ample growth opportunities for the market players in the global medical gas and equipment market in the following years.

Trends in Medical Gas & Equipment Market

The key players in the medical gas & equipment market are focusing on expanding their production capacities in order to meet the to the growing demand for more medical gas & equipment across the globe by means of various inorganic strategies such as acquisitions, agreements, and partnerships. For instance, in May 2021, Atlas Copco acquired Medigas Service & Testing Co. Inc., a New York based supplier of medical gases, to strengthen and expand our support to both healthcare and laboratory customers in the strategic New York area.

The major market players also focus on geographical expansions to enter new markets and strengthen their presence across various regions. Below are some of the instances.

In 2021, Air Liquide has announced a 40% stake acquisition in the capital of the French company H2V Normandy, a subsidiary of H2V Product, which aims to build a large-scale electrolyzer complex of up to 200 MW for the production of renewable and low-carbon hydrogen in France.

Medical Gases and Equipment Market Regional Analysis

The market is analyzed into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. North America accounted for leading share in 2023. North America medical gas and equipment market size was estimated to be USD 7,113.5 Million in 2022 and is expected to reach USD 10,304.8 Million by 2032, growing at a compound annual growth rate (CAGR) of 6.7% during the forecast period i.e. 2023-2032. Factors such as high healthcare expenditure and presence of robust healthcare infrastructure are believed to positively drive the growth of market.

Asia Pacific medical gas and equipment market size was estimated to be USD 3,616.8 Million in 2022 and is expected to reach USD 6,798.5 Million by 2032, growing at a compound annual growth rate (CAGR) of 11.4% during the forecast period i.e. 2023-2032.

The rapid growth in the developing healthcare industry across China and India is expected to offer significant growth opportunities for players operating in this market during the forecast period. In addition, factors such as increasing incidence of respiratory diseases as well as growth in the healthcare infrastructure and the per capita income in this region are also expected to drive the growth of the medical gases and equipment market in this region.

Medical Gases and Equipment Market Key Players

- Linde Plc

- Air Liquide

- Air Products Inc.

- Messer Group GmbH

- Praxair Technology, Inc.

- BeaconMedaes

- Matheson Tri-Gas, Inc.

- TAIYO NIPPON SANSO CORPORATION

- Amico Group of Companies

- Atlas Copco

Medical Gases and Equipment Market Segmentation

By Type

- Pure Medical Gases

- Oxygen

- Carbon Dioxide

- Nitrogen

- Nitrous Oxide

- Medical Air

- Helium

- Medical Gas Mixtures

- Blood-Gas Mixtures

- Lung Diffusion Mixtures

- Nitrous Oxide-Oxygen Mixtures

- Carbon Dioxide-Oxygen Mixtures

- Laser-Gas Mixtures

- Ethylene Oxide/Sterilant Gas Mixtures

- Other Gas Mixtures

- Medical Gas Equipment

- Equipment Accessories

- Vacuum Systems

- Manifolds

- Regulators

- Flowmeters

- Hoses & Valves

- Monitoring Systems (Alarms & Monitors)

- Medical Air Compressors

- Others

- Gas Delivery Systems

- Cryogenic Products (Freezers)

By Application

- Therapeutic Applications

- Pharmaceutical Manufacturing & Research

- Diagnostic Applications

- Other Applications

By End User

- Hospitals

- Home Healthcare

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Others

|

Attribute |

Data |

|

Market Size (2022) |

USD 17,141.0 Million |

|

Forecast (2032) |

USD 26,765.8 Billion |

|

CAGR (2023-2032) |

8.8% |

|

Segmentation |

Type, Application, End User |

|

Types |

- Medical Gas (Pure Medical Gases, Medical Gas Mixtures) - Medical Gas Equipment (Equipment Accessories, Cryogenic Products, Gas Delivery Systems) |

|

Applications |

Therapeutic, Diagnostics, Pharmaceutical Manufacturing & Research, Others |

|

End Users |

Hospitals, Home Healthcare, Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Others |

|

Growth Drivers |

- Rising prevalence of chronic diseases - Increasing technological advancements |

|

Notable Trends |

- Expansion of production capacities - Geographical expansions |

|

Regional Analysis |

- North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Notable Companies |

Linde Plc, Air Liquide, Air Products Inc., Messer Group GmbH, Praxair Technology, Inc., BeaconMedaes, Matheson Tri-Gas, Inc., TAIYO NIPPON SANSO CORPORATION, Amico Group of Companies, Atlas Copco |

|

Notable Regional Analysis |

- North America: USD 7,113.5 Million (2022) to USD 10,304.8 Million (2032), CAGR 6.7% - Asia Pacific: USD 3,616.8 Million (2022) to USD 6,798.5 Million (2032), CAGR 11.4% |

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -