Liquid Biopsy Market

Liquid Biopsy Market Trend, Opportunity, and Forecast Analysis, 2024-2032

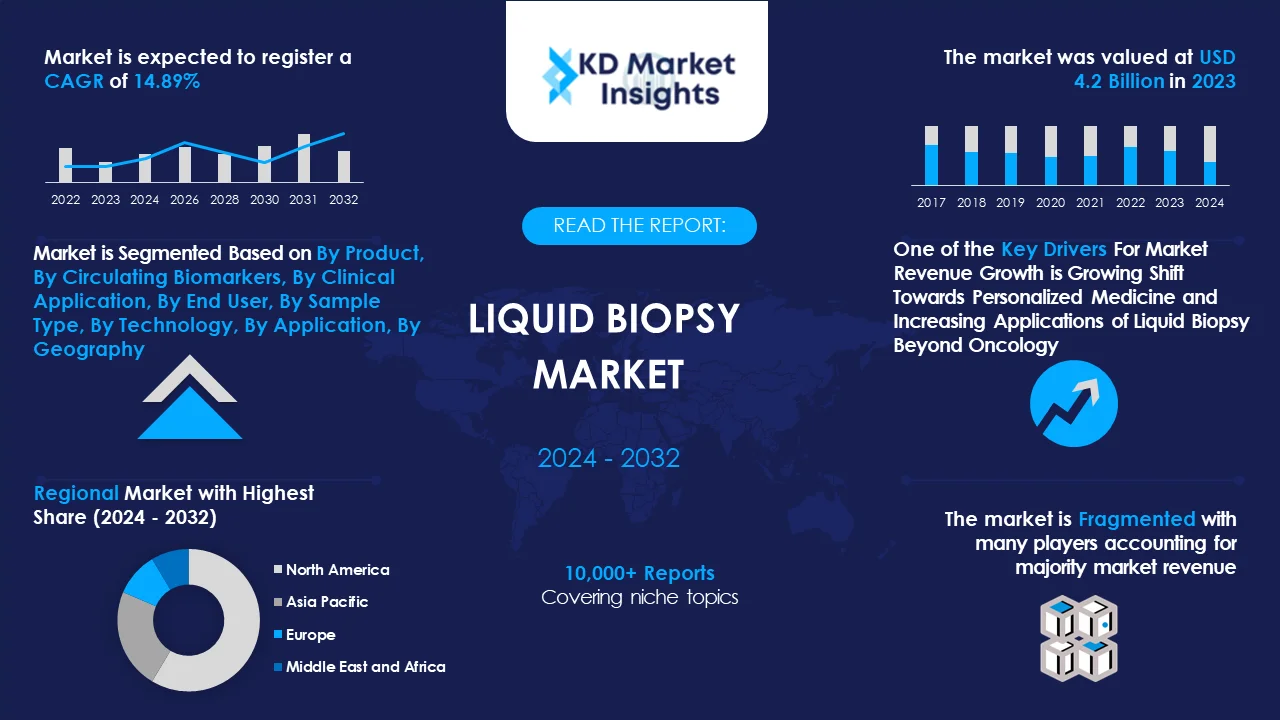

Liquid Biopsy Market is segmented by Product, Circulating Biomakers, Clinical Application, End-User, Sample Type, Technology, Application, and by Region. KDMI analyst foresees market revenue to cross USD 20.4 Billion by 2032 by growing with a CAGR of 14.89% during 2024-2032.

Liquid Biopsy Market Highlights

The global liquid biopsy market is expected to cross a value of USD 20.4 billion by the end of 2032. The market was valued at USD 4.2 billion in 2023 and is expected to expand at a CAGR of 14.89% between 2024-2032.

- Over the mid-term, the growing focus on early cancer detection is the primary factor anticipated to drive the global liquid biopsy market.

- The high cost of liquid biopsy is a major factor to challenge the market growth.

- The North America liquid biopsy market is projected to dominate the global market.

Liquid Biopsy Market: Report Scope |

|

|

Base Year |

2023 |

|

Base Year Market Size |

4.2 Billion |

|

Forecast Year |

2024-2032 |

|

Forecast Year Market Size |

USD 20.4 Billion |

|

CAGR Value |

14.89% |

|

Liquid Biopsy Market Key Trends/Major Growth Drivers |

|

|

Restraint Factors |

|

|

Liquid Biopsy Market Segmentation |

|

|

Liquid Biopsy Market Key Players |

Amoy Diagnostics, ArcherDX, Biocartis, Cell Search, CellMax Life, Datar Cancer Genetics, DiaCarta, EONE-DIAGNOMICS, Exosome Diagnostics, GeneCast Biotechnology, Integrated DNA Technologies, Lucence, MDNA Life Sciences, Miltenyi Biotec, NeoGenomics, ONCODE Scientific, OncoDNA, QIAGEN, PANAGENE, Personal Genome Diagnostics, Predicine, ScreenCell, Tecan, Thermo Fisher Scientific, and others. |

Liquid Biopsy Market Outlook

The human body consists of several bodily fluids, such as such as blood, urine, or cerebrospinal fluid. These fluids consists of several biomarkers, such as circulating tumor cells (CTCs), cell-free DNA (cfDNA), circulating tumor DNA (ctDNA), RNA, proteins, and exosomes. The non-invasive diagnostic procedure of analyzing these biomarkers that help in providing valuable information about the genetic mutations, molecular alterations, and other biomarkers associated with various diseases, particularly cancer, is known as liquid biopsy.

According to our experts at KD Market Insights, the growing prevalence of cancer, which is driving the focus of healthcare professionals for early cancer detection, is one of the major factors expected to raise the demand for non-invasive liquid biopsy products. According to the statistics by the World Health Organization (WHO), cancer-related deaths in the year 2020 was nearly 10 million, making it one of the leading causes of death globally. Liquid biopsies offer a non-invasive method for early cancer detection. The process helps in monitoring treatment response, and detecting minimal residual disease. As a result, liquid biopsy is known to contribute much to improve patient outcomes and survival rates. Amoy Diagnostics, ArcherDX, Biocartis are some of the significant parties in the global market for liquid biopsy.

Get More Insights on This Report - Request Free Sample PDF

Get More Insights on This Report - Request Free Sample PDF

Liquid Biopsy Market Drivers – Analyst’s Observation

According to the analysts at KD Market Insights, some key growth drivers for the global liquid biopsy market are:

- Growing Shift Towards Personalized Medicine: Liquid biopsies play a crucial role in personalized medicine by providing real-time information on tumor genetic mutations, heterogeneity, and treatment resistance. By analyzing genetic alterations and molecular biomarkers in patient blood samples, liquid biopsies help oncologists tailor treatment strategies, select targeted therapies, and monitor disease progression. Our researchers predict that the revenue generated from personalized medicine is expected to reach near to USD 1200 billion by the end of 2032, registering a CAGR of close to 8% during the forecast period.

- Increasing Applications of Liquid Biopsy Beyond Oncology: With the growing advancements in the field of pharmaceutical science, researchers are increasingly growing interest in expanding the applications of liquid biopsy in applications to other disease areas, such as non-invasive prenatal testing, infectious diseases, transplant monitoring, and autoimmune disorders. The versatility and potential of liquid biopsies in detecting various biomarkers and genetic aberrations make them valuable tools for diagnosing and managing a wide range of medical conditions which is expected to contribute to the growth of the market in the coming years.

Which Probable Factors Could Hamper the Growing Liquid Biopsy Market Trend?

As per our KD Market Insights analysis, some of the challenges expected to limit the global market growth of liquid biopsy are:

- Limited Clinical Validation and Standardization: The lack of standardized protocols and clinical validation studies associated with liquid biopsy is expected to limit the market growth in the coming years.

- High Cost of Liquid Biopsy: Liquid biopsy tests are known to be costlier, especially those tests which are based on advanced technologies such as next-generation sequencing (NGS). Such a factor is therefore projected to act as a major restraint factor for the market growth.

How is the Global Liquid Biopsy Market Segmented?

Our experts at KD Market Insights have segmented the global liquid biopsy market as:

|

By Product & Service |

|

|

By Circulating Biomarkers |

|

|

By Application |

|

|

By Technology |

|

|

By Clinical Application |

|

|

By End User |

|

|

By Sample Type |

|

|

By Region |

|

What are the Probable Factors Influencing the North America Liquid Biopsy Market Forecast?

The North America liquid biopsy market is majorly driven by the increasing prevalence of cancer in the region, along with the ongoing advancements witnessed in liquid biopsy technologies. According to the statistics by the American Cancer Society, in the year 2022, estimated numbers of new cancer cases and deaths would be 1.9 million new cases and 609,360 cancer deaths respectively. Besides this, the growing collaboration between industry players, academic institutions, and healthcare organizations in the region, that fosters innovation and accelerates the development and commercialization of liquid biopsy technologies are some of the additional factors anticipated to drive the growth of the market in the coming years.

As per our analysts at KD Market Insights, the following five players lead the North America liquid biopsy market growth:

- Guardant Health

- GRAIL

- Exact Sciences Corporation

- Biocept, Inc.

- Foundation Medicine

|

Key Countries to Watch for in North America Liquid Biopsy Market |

Key Insights |

|

United States Liquid Biopsy Market to Register the Largest Regional Market Share |

USD 5.7 Billion |

|

Canada Liquid Biopsy Market to Grow with the Highest CAGR During 2024-2032 |

15.2% |

Which Key Players Top the Global Liquid Biopsy Market Share?

As per our analysts at KD Market Insights, the competitive landscape of global liquid biopsy market facilitates our readers in identifying their closest competitors. The manufacturers who are associated with liquid biopsy market are raising their focus on expanding their presence, as well as their market share. The market has also been witnessing an upward movement in the number of collaborations between research institutions and key players, aimed at introducing advanced technologies and innovation of new products. Here is a list of the key players who top the global liquid biopsy market share:

- Amoy Diagnostics

- ArcherDX, Biocartis

- Cell Search

- CellMax Life

- Datar Cancer Genetics

- DiaCarta

- EONE-DIAGNOMICS

- Exosome Diagnostics

- GeneCast Biotechnology

- Integrated DNA Technologies

- Lucence

- MDNA Life Sciences

- Miltenyi Biotec

- NeoGenomics

- ONCODE Scientific

- OncoDNA

- QIAGEN

- PANAGENE

- Personal Genome Diagnostics

- Predicine

- ScreenCell

- Tecan

- Thermo Fisher Scientific

What are the Recent Developments Observed in the Liquid Biopsy Market?

Over the years, the experts at KD Market Insights have been observing the recent developments associated with global liquid biopsy market trends. Our expert’s market forecast analysis has recorded the market players adopting plentiful of key strategies including new product launches, mergers & acquisitions, and collaborations.

For instance, QIAGEN shared that it has collaborated with Sysmex Corporation for developing and commercializing cancer companion diagnostics using NGS and Plasma-Safe-SeqS technology.

Further, Illumina, Inc. stated that it has entered into a collaboration with Bristol Myers Squibb for innovating and enhancing companion diagnostics for therapy selection to further precision oncology.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -