Diabetes Diagnostic Market

Diabetes Diagnostic Market Trend, Opportunity, and Forecast Analysis, 2024-2032

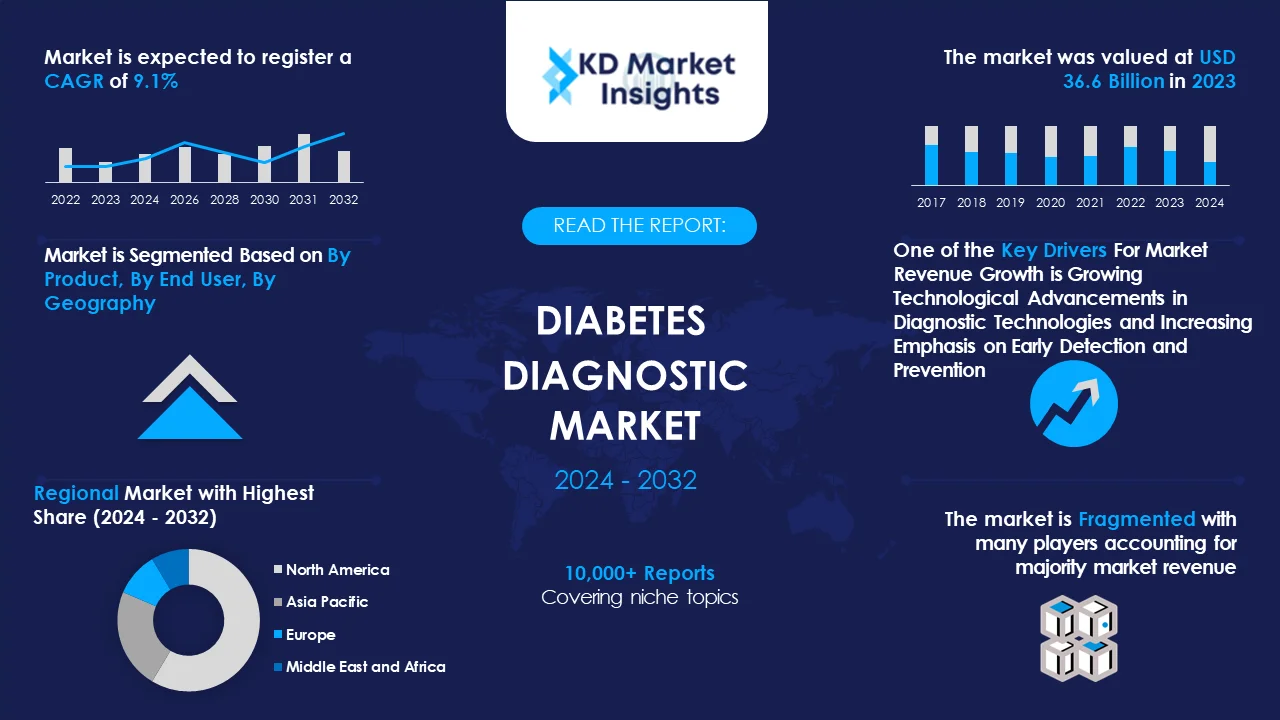

Diabetes Diagnostic Market is segmented by Product, End User, and by Region. KDMI analyst foresees market revenue to cross USD 70.7 Billion by 2032 by growing with a CAGR of 9.1% during 2024-2032.

Diabetes Diagnostic Market Highlights

The global diabetes diagnostic market is expected to cross a value of USD 70.7 billion by the end of 2032. The market was valued at USD 36.6 billion in 2023 and is expected to expand at a CAGR of 9.1% between 2024-2032.

- Over the mid-term, the increasing incidence of diabetes is the primary factor anticipated to drive the global diabetes diagnostic market.

- The high cost of diabetes diagnostic tests is a major factor to challenge the market growth.

- The North America diabetes diagnostic market is projected to dominate the global market.

Diabetes Diagnostic Market: Report Scope |

|

|

Base Year |

2023 |

|

Base Year Market Size |

USD 36.6 Billion |

|

Forecast Year |

2024-2032 |

|

Forecast Year Market Size |

USD 70.7 Billion |

|

CAGR Value |

9.1% |

|

Diabetes Diagnostic Market Key Trends/Major Growth Drivers |

|

|

Restraint Factors |

|

|

Diabetes Diagnostic Market Segmentation |

|

|

Diabetes Diagnostic Market Key Players |

Medtronic plc, Abbott Laboratories, F.Hoffmann-La Roche Ltd., Bayer AG, Lifescan, Inc., B. Braun Melsungen AG, Lifescan, Inc., Dexcom Inc., Insulet Corporation, Ypsomed Holdings, Companion Medical, Sanofi, Valeritas Holding Inc., Novo Nordisk, ARKRAY, Inc., and others. |

Diabetes Diagnostic Market Outlook

The process of identifying, diagnosing, and monitoring diabetes mellitus, a chronic metabolic disorder characterized by elevated blood glucose levels, is known as diabetes diagnostics. Diabetes diagnostics involve various tests and procedures aimed at detecting diabetes, determining its type and severity, monitoring blood glucose levels, assessing risk factors, and evaluating diabetes-related complications.

According to our experts at KD Market Insights, the increasing incidence of diabetes globally is one of the primary factors associated with the growth of the market. According to the statistics by the International Diabetes Federation (IDF), 10.5% of the adult population globally were known to have diabetes in the year 2021. The statistics also predicted that 1 in 8 adults, reaching about 783 million, would be living with diabetes by 2045. Medtronic plc, Abbott Laboratories, and F.Hoffmann-La Roche Ltd. are some of the significant parties in the global market for diabetes diagnostic.

Get More Insights on This Report - Request Free Sample PDF

Get More Insights on This Report - Request Free Sample PDF

Diabetes Diagnostic Market Drivers – Analyst’s Observation

According to the analysts at KD Market Insights, some key growth drivers for the global diabetes diagnostic market are:

- Growing Technological Advancements in Diagnostic Technologies: The rise in advancements witnessed in diagnostic technologies over the years, such as, point-of-care testing, continuous glucose monitoring (CGM) systems, and non-invasive glucose monitoring devices, that allow diagnostic service providers enhanced accuracy, speed, and convenience of diabetes diagnostics. These technological innovations improve patient outcomes and facilitate early detection, which is expected to drive the market growth.

- Increasing Emphasis on Early Detection and Prevention: Healthcare initiatives aimed at early detection and prevention of diabetes-related complications are gaining prominence globally. Screening programs, public health campaigns, and proactive healthcare interventions focus on identifying individuals at risk of diabetes or prediabetes, are resulting in an increase in demand for diabetes diagnostics tests, which is expected to drive the market growth.

Which Probable Factors Could Hamper the Growing Diabetes Diagnostic Market Trend?

As per our KD Market Insights analysis, some of the challenges expected to limit the global market growth of diabetes diagnostic are:

- High Cost of Diabetes Diagnostic Tests: The cost of diabetes diagnostic tests and equipment can be prohibitive for some patients, particularly in regions with limited access to healthcare resources or inadequate insurance coverage. This, as a result, is expected to limit the market growth.

- Growing Stigma and Fear of Diagnosis: Stigma associated with diabetes and fear of receiving a diagnosis may discourage individuals from undergoing diagnostic testing, especially in cases of prediabetes or asymptomatic diabetes, which is projected to hinder the growth of the market in the coming years.

How is the Global Diabetes Diagnostic Market Segmented?

Our experts at KD Market Insights have segmented the global diabetes diagnostic market as:

|

By Product |

|

|

By End User |

|

|

By Region |

|

What are the Probable Factors Influencing the North America Diabetes Diagnostic Market Forecast?

The North America diabetes diagnostic market is majorly driven by surge in prevalence of diabetes as the region is facing a growing epidemic of the disease. A significant portion of the North American population is affected by either type 1 or type 2 diabetes. According to the statistics by the American Diabetes Association (ADA), 38.4 million Americans had diabetes in the year 2021. On the other hand, the North America region has one of the highest healthcare expenditures globally, with significant investments in healthcare infrastructure, technology, and services. This facilitates greater accessibility to diabetes diagnostic tests, and supports reimbursement for diagnostic procedures, which is expected to contribute to the market growth in the region.

As per our analysts at KD Market Insights, the following five players lead the North America diabetes diagnostic market growth:

- Abbott Laboratories

- Dexcom, Inc.

- Roche Diabetes Care, Inc.

- Medtronic plc

- Ascensia Diabetes Care Holdings AG

|

Key Countries to Watch for in North America Diabetes Diagnostic Market |

Key Insights |

|

United States Diabetes Diagnostic Market to Register the Largest Regional Market Share |

USD 19.8 Billion |

|

Canada Diabetes Diagnostic Market to Grow with the Highest CAGR During 2024-2032 |

9.5% |

Which Key Players Top the Global Diabetes Diagnostic Market Share?

As per our analysts at KD Market Insights, the competitive landscape of global diabetes diagnostic market facilitates our readers in identifying their closest competitors. The manufacturers who are associated with diabetes diagnostic market are raising their focus on expanding their presence, as well as their market share. The market has also been witnessing an upward movement in the number of collaborations between research institutions and key players, aimed at introducing advanced technologies and innovation of new products. Here is a list of the key players who top the global diabetes diagnostic market share:

- Medtronic plc

- Abbott Laboratories

- F.Hoffmann-La Roche Ltd.

- Bayer AG

- Lifescan, Inc.

- B. Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Sanofi

- Valeritas Holding Inc.

- Novo Nordisk

- ARKRAY, Inc.

What are the Recent Developments Observed in the Diabetes Diagnostic Market?

Over the years, the experts at KD Market Insights have been observing the recent developments associated with global diabetes diagnostic market trends. Our expert’s market forecast analysis has recorded the market players adopting plentiful of key strategies including new product launches, mergers & acquisitions, and collaborations.

For instance, Senseonics stated that it has received approval from the U.S. Food and Drug Administration (FDA) for its Implantable Eversense Continuous Glucose Monitoring (CGM) system in the United States.

Further, LifeScan shared that it has partnered with DKSH to avail its supervisory assistance and distribution and logistics for the sales of LifeScan products in the Asia Pacific.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -