Commercial aquaculture vaccines market by Type (Inactivated Vaccines, Attenuated Vaccines, DNA Vaccines, Subunit Vaccines, Others), target species (Fish, Shellfish, Others), disease type (Viral Diseases, Bacterial Diseases, Parasitic Diseases, Fungal Diseases, Others) End-use Industry (Aquaculture Farms, Hatcheries, Research Institutes, Others) and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032

Commercial Aquaculture Vaccines Market

Commercial aquaculture vaccines market by Type (Inactivated Vaccines, Attenuated Vaccines, DNA Vaccines, Subunit Vaccines, Others), target species (Fish, Shellfish, Others), disease type (Viral Diseases, Bacterial Diseases, Parasitic Diseases, Fungal Diseases, Others) End-use Industry (Aquaculture Farms, Hatcheries, Research Institutes, Others) and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032

Market Size and Overview:

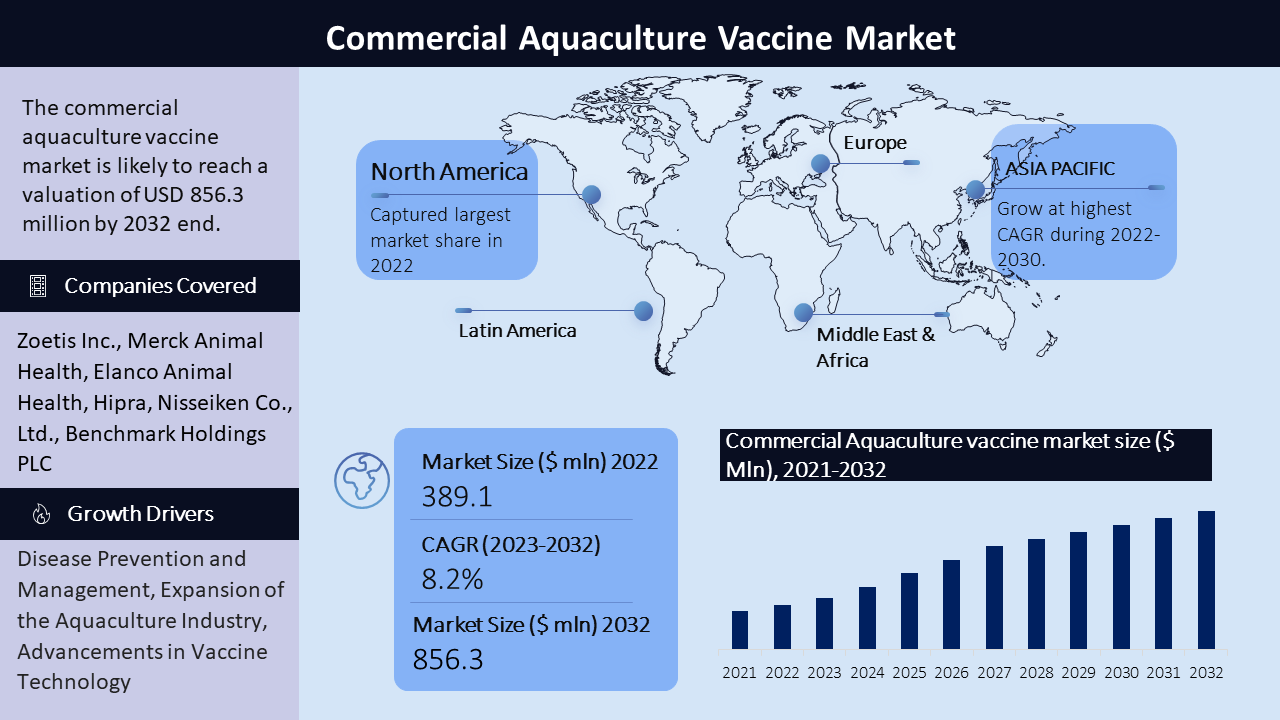

The global commercial aquaculture vaccines market size was valued at USD 389.1 million in 2022. It is estimated to reach USD 856.3 million by 2032, growing at a CAGR of 8.2% during the forecast period (2023–2032). The commercial aquaculture vaccines market refers to the market for vaccines specifically developed and used in the aquaculture industry to prevent or control diseases in farmed aquatic species. Vaccines play a crucial role in maintaining the health and productivity of aquaculture operations by reducing the impact of infectious diseases.

|

Commercial Aquaculture Vaccines Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

8.2% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Commercial Aquaculture Vaccines Market Segmentation

The commercial aquaculture vaccines market is segmented:

By Vaccine Type:

- Inactivated Vaccines

- Attenuated Vaccines

- DNA Vaccines

- Subunit Vaccines

- Others

By Target Species:

- Fish

- Shellfish

- Others

By Disease Type:

- Viral Diseases

- Bacterial Diseases

- Parasitic Diseases

- Fungal Diseases

- Others

By End-User:

- Aquaculture Farms

- Hatcheries

- Research Institutes

- Others

By Distribution Channel:

- Direct Sales

- Veterinary Clinics and Hospitals

- Online Retailers

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The fish segment is the leading segment in the commercial aquaculture vaccines market. Fish, including salmon, trout, tilapia, and catfish, are among the most framed species in aquaculture. They are susceptible to a wide range of viral and bacterial diseases that can significantly impact the productivity and profitability of aquaculture operations. As a result, vaccines targeted specifically for fish species are in high demand.

Commercial Aquaculture Vaccines Market Regional Synopsis

North America has a significant presence in the commercial aquaculture vaccines market, with the United States and Canada being major contributors. The region has a well-developed aquaculture industry, particularly in salmon and trout farming. Crucial players in this region include multinational pharmaceutical companies and specialized vaccine manufacturers.

Europe is another important market for commercial aquaculture vaccines. Norway, Scotland, and the Nordic countries have well-established salmon farming industries, driving the demand for vaccines in this region. Several European countries have implemented strict regulations and guidelines for aquaculture practices, including the use of vaccines to ensure the health and welfare of farmed fish.

Asia Pacific is a significant market for commercial aquaculture vaccines, driven by the presence of major aquaculture-producing countries like China, India, and Vietnam. China is the largest producer of aquaculture products globally, contributing to the demand for vaccines in the region.

Latin America has a growing commercial aquaculture vaccine market, with countries like Chile, Brazil, and Ecuador being major players in the region. Chile is a leading producer of farmed salmon and has a well-established aquaculture industry. Disease outbreaks in salmon farming have led to increased investment in vaccine research and development in the region.

The Middle East and Africa region has a growing aquaculture sector, with countries like Saudi Arabia, Egypt, and South Africa leading the way. The region faces unique challenges related to climate, water availability, and disease management. Vaccines play a crucial role in preventing disease outbreaks and ensuring sustainable aquaculture practices in the region.

Commercial Aquaculture Vaccines Market Driving Factors

Disease outbreaks can harm aquaculture farms, leading to significant economic losses. Vaccination plays a crucial role in preventing and managing diseases in farmed aquatic species. The need to reduce the incidence and severity of disease drives the demand for commercial aquaculture vaccines.

The global demand for seafood continues to rise, and aquaculture has come a major source of seafood production. The expansion of the aquaculture industry drives the demand for commercial aquaculture vaccines to ensure the health and welfare of farmed aquatic species, thereby increasing productivity and profitability.

Governments and regulatory bodies are recognizing the importance of vaccines in aquaculture disease management. They are implementing regulations and guidelines to promote the safe and effective use of vaccines. The emphasis on biosecurity measures and disease control further drives the adoption of commercial aquaculture vaccines.

Consumers are becoming more conscious about the safety and quality of the seafood they consume. They demand sustainable and responsibly sourced seafood products. The use of vaccines in aquaculture contributes to safer and healthier seafood production, meeting consumer expectations and increasing market demand.

Continuous advancements in vaccine technology, including the development of more effective adjuvants, improved delivery systems, and innovative vaccine formulation, drive the growth of the commercial aquaculture vaccines market. These advancements result in safer, more efficient, and targeted vaccines for disease prevention in farmed aquatic species.

Commercial Aquaculture Vaccines Market Challenges

Aquatic conditions can be complex and highly variable, making it challenging to develop vaccines that provide broad protection against all strains and variations. The ability of pathogens to evolve and change adds complexity to vaccine development efforts.

While vaccines exist for many important diseases in aquaculture, there are still some diseases for which effective vaccines are lacking or not yet commercially available. Developing vaccines for certain viral, bacterial, and parasitic diseases can be technically challenging and time-consuming.

Commercial Aquaculture Vaccines Market Key Players

Some prominent players in the commercial aquaculture vaccines market are:

- Zoetis Inc.

- Merck Animal Health

- Elanco Animal Health

- Hipra

- PHARMAQ AS

- Tecnovax

- Veterquimica S.A.

- Genetech Biotechnology

- Nisseiken Co., Ltd.

- Benchmark Holdings PLC

- Ceva Santé Animale

- Centrovet Laboratories

- Vaxxinova

- BioMarin Veterinary Sciences

- Virbac

- Others players

As a strategic extension of its PharmaQ business, Zoetis purchased Fish Vet Group from Benchmark Holdings, PLC in July 2020. The Fish Vet Company develops and distributes fish vaccines and offers immunization and diagnostic services for aquaculture.

With the development and production of the COVID-19 vaccine in December 2020, HIPRA took a significant step in the direction of improving human health. Salvador Illa, the Spanish Minister of Health, Visited HIPRA and Emphasised the innovative capabilities of the pahramceutical firm for addressing this new stage.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -