Baby Drinks Market By Product Type By Infant formula, Baby juice, Baby tea, Baby electrolyte solutions, Others (including plant-based milks and probiotic drinks);By distribution channel(Supermarkets and hypermarkets, Convenience stores, Online channels, others (including specialty stores and pharmacies)};By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

Baby Drinks Market: Overview and Definition

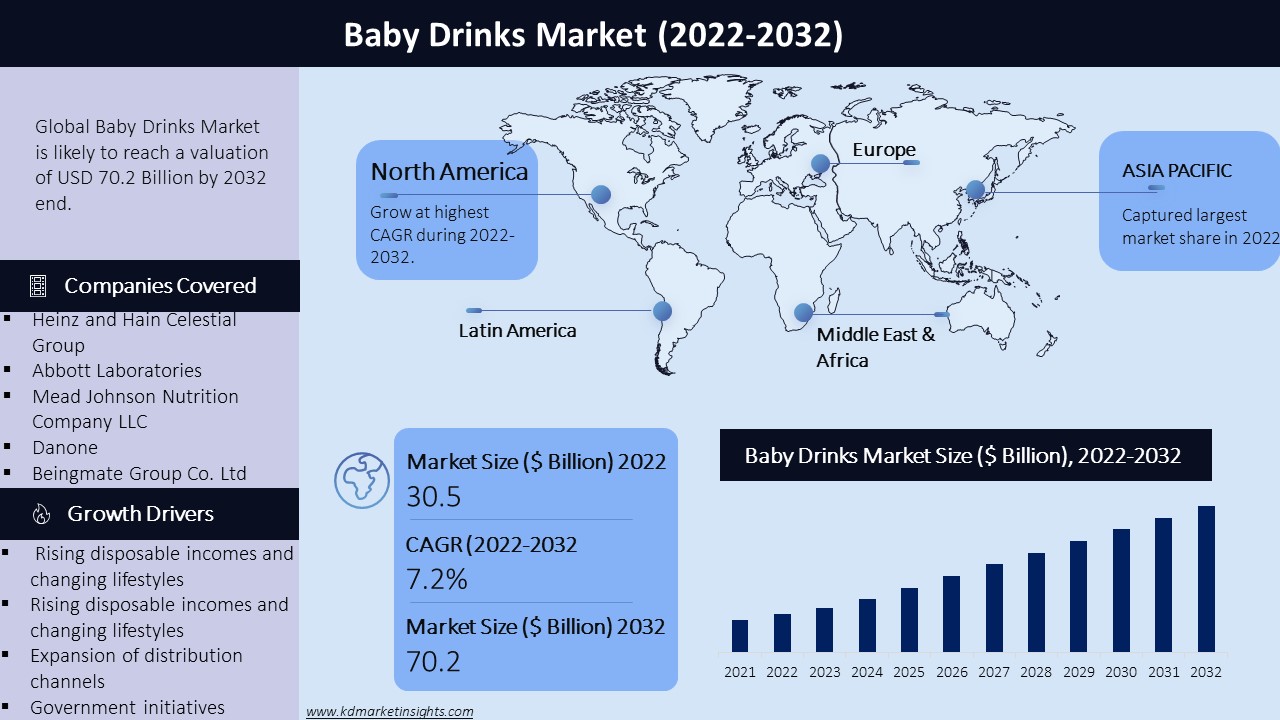

The global baby drinks market size was valued at USD 30.5 billion in 2021 and is projected to reach USD 70.2 billion by 2032, registering a CAGR of 7.2% during the forecast period 2022-2032. Baby drinks include items such as infant formula, baby electrolyte, and baby juice, all of which provide nutrients and vitamins that aid in a baby's development. These are made from fruit juices and are intended for youngsters under the age of three. Infant formula is a dried milk product that offers nutrients that are identical to those found in natural breast milk. The baby drinks market includes a variety of goods for new-borns and toddlers, including as infant formula, baby juice, and baby electrolyte. Because of its high nutrient content, infant formula is a widely accepted alternative to nursing. For healthy and full-term infants, Enspire infant formula and toddler milk, as well as Similar infant formula and toddler milk, are two of the most popular infant formulas. Baby juices are 100% natural fruit juices that are specially produced for children under the age of three.

The baby drinks market includes a range of products such as infant formula, baby juice, baby tea, and baby electrolyte solutions. It is driven by factors such as increasing awareness of the importance of proper infant nutrition, rising disposable incomes, and a growing preference for convenient and ready-to-drink options. The market is also impacted by regulatory frameworks, product innovation, and marketing and promotional activities by key players. North America and Europe are the largest markets, while Asia Pacific is expected to exhibit the highest growth rate in the coming years.

Baby Drinks Market Key Drivers

- Increasing awareness of the importance of proper infant nutrition.

- Rising disposable incomes and changing lifestyles, which have led to a growing preference for convenient and ready-to-drink options.

- Growing demand for natural and organic baby drinks.

- Advancements in product formulation and packaging technology.

- Expansion of distribution channels, including e-commerce platforms.

- Rising birth rates and an increasing population of working women.

- Government initiatives to improve infant health and nutrition.

- Emergence of private label brands offering affordable baby drink options.

- Increasing adoption of infant formula due to a rise in the number of mothers unable to breastfeed.

Top Impacting Factors

The baby drinks market is being driven by the increasing use of infant drinks in a number of nations. The US government, for example, is funding a special supplemental nutrition programme for women, infants, and children (WIC). Companies are also employing marketing strategies to boost sales in Asia, Africa, and Latin America.

When it comes to infant drinks, a lot of factors influence consumer purchasing decisions, including nutritional content, product safety regulations, and price. Manufacturers are working on producing high-quality products with maximum nutrition levels, taking these elements into account. Consumers choose online platforms to buy infant drinks, owing to the convenience and vast selection of items available for comparison.

Infant formula makers must comply with certain standards in order to sell their products in the United States, according to the Federal Food, Drug, and Cosmetic Act (FFDCA). Baby formula should contain all 29 necessary components required to maintain infant nutrition levels, according to these guidelines. The Food Safety Law, which was updated in the last three years, regulates infant formula in China. Following the melamine incident in 2008, over 30,000 babies had kidney stones and other ailments as a result of consuming tainted infant formula. As a result, China's government enacted strict rules for the production and marketing of infant formula.

Latest Trends

For example, approximately 47.0 percent of the 123 million women in the United States were employed. Until 2018, women were expected to make up 51.0 percent of the entire workforce. This reason has fuelled the need for a variety of baby drinks to meet the nutritional needs of infants. More over 45 percent of women worldwide work in compensated employment, with the majority of young women opting for non-traditional professional roles. By 2025, a 10% increase in women's labour force participation is predicted to add USD 700 billion to India's GDP, which is equivalent to a 1.4 percent rise. As a result, demand for baby beverages to feed infants is likely to rise.

Baby Drinks Market: Challenges

The baby drinks market faces several challenges, including:

- Stringent regulations on baby drinks and infant formula.

- Concerns regarding the safety and quality of baby drinks.

- Rising competition from other baby food products.

- Health risks associated with the consumption of sweetened baby drinks.

- Lack of awareness and education about the proper use and storage of baby drinks.

- Limited availability of affordable baby drinks in developing countries.

- Cultural barriers to the adoption of formula and other packaged baby drinks in some regions.

- Increasing popularity of breast milk substitutes, such as donor milk and homemade infant formula.

- The impact of the COVID-19 pandemic on the supply chain and demand for baby drinks.

|

Baby Drinks Market : Report Scope |

|

|

Base Year Market Size |

2021 |

|

Forecast Year Market Size |

2022-2032 |

|

CAGR Value |

7.2 % |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Baby Drinks Market Segmentation

The baby drinks market can be segmented by product type, distribution channel, and region.

By Product Type

- Infant formula

- Baby juice

- Baby tea

- Baby electrolyte solutions

- Others (including plant-based milks and probiotic drinks)

By distribution channel

- Supermarkets and hypermarkets

- Convenience stores

- Online channels

- Others (including specialty stores and pharmacies)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Baby Drinks Market Regional Synopsis

Due to its vast population of children aged 0 to 4, Asia-Pacific is the greatest revenue contributor to the global baby drinks market. The rise of the infant drinks industry has been fuelled by increased female involvement in the labour force in countries such as China, India, South Korea, and Indonesia. Furthermore, the market has grown due to an increase in disposable money, a busy lifestyle, and a higher level of living in these regions. In terms of revenue, China topped the infant drinks market in 2016, with a 56.9% share in the Asia-Pacific region.

Brazil contributes the most to the LAMEA baby drinks market. This is due to customers' high disposable income and the fact that Brazil has a big population of working women. According to the World Bank, women account for 43.1 percent of the total labour force in Brazil. Furthermore, Saudi Arabia is expected to develop at the fastest rate due to its high birth rate and high consumer discretionary income. Saudi Arabia's birth rate is projected to be 20 per 1,000 people, according to the World Bank.

Baby Drinks Market Key Players

- Heinz and Hain Celestial Group

- Abbott Laboratories

- Mead Johnson Nutrition Company LLC

- Danone

- Beingmate Group Co. Ltd

- HiPP GmbH & Co

- Campbell Soup Company

- Arla Foods

- D. Signstore

- Dano Food

- Dana Dairy Group Ltd

- Nestle S.A

Baby Drinks Market: Recent Developments

The baby drinks market has seen several recent developments, including:

- Growing demand for organic and natural baby drinks, with companies such as Plum Organics, Happy Family Organics, and Earth's Best introducing new product lines in this category.

- Introduction of plant-based baby drinks, such as almond and soy-based baby formula, to cater to the rising demand for vegan and vegetarian products.

- Increasing focus on sustainable packaging options, with companies such as Danone and Nestle introducing recyclable and biodegradable packaging solutions.

- Innovation in product formulation, with companies such as Enfamil introducing new formulas that are closer to breast milk in terms of nutritional composition.

- Expansion of distribution channels, with the growing popularity of e-commerce platforms such as Amazon and Walmart.

- Investment in research and development to develop new products that cater to the specific nutritional needs of infants and toddlers.

- Launch of premium and high-end baby drinks, such as organic and artisanal juices and teas, targeting affluent and health-conscious consumers.

- Regulatory developments, including stricter labeling and marketing guidelines for infant formula and baby drinks in certain regions.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -