Acetic Acid Market By Derivatives(Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Ethyl Acetate, Acetic Anhydride, Other Derivatives); By Application (Plastics and Polymers, Food and Beverage, Adhesives, Paints, and Coatings, Textile, Medical); By End-Use Industry (Food and beverages, Paints and coating, Plastics & Polymers, Pharmaceutical, Chemicals); ; By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

Acetic Acid Market Insights

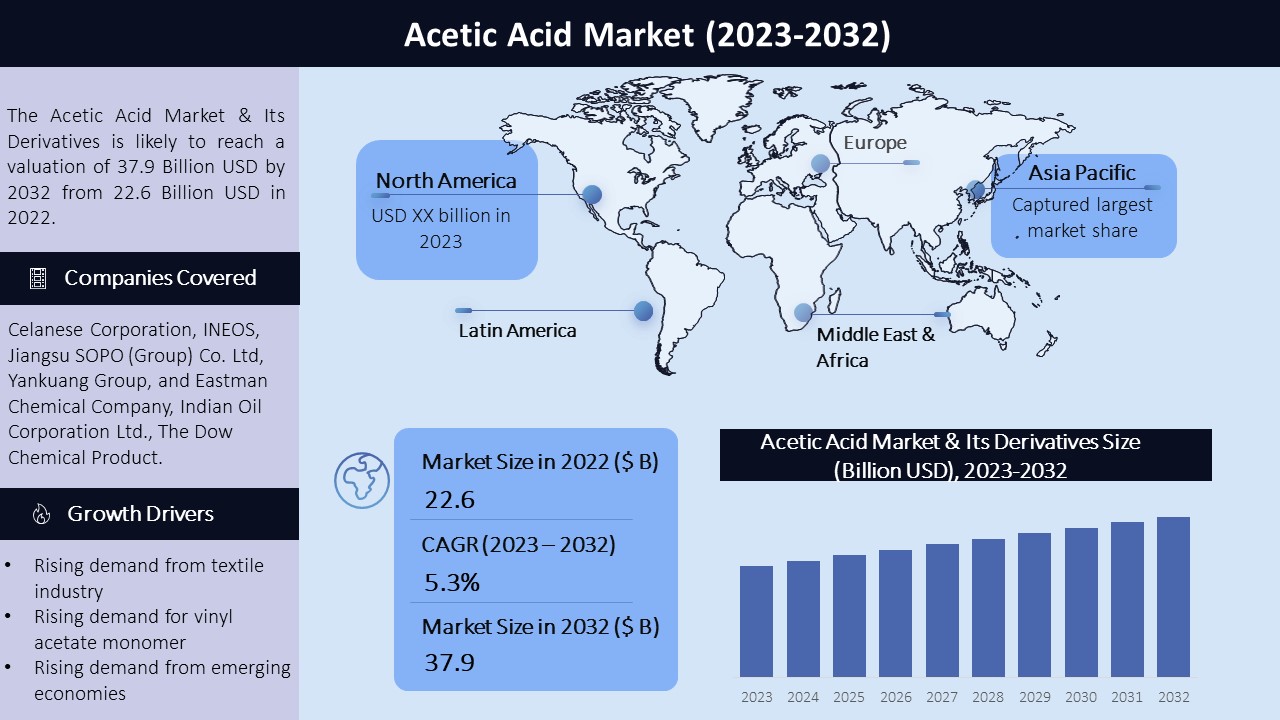

The acetic acid market & its derivatives have experienced steady growth, with a compound annual growth rate (CAGR) of 5.3% from 2023 to 2032, reaching a market value of USD 37.9 billion in 2032, according to KD Market Insights. This growth can be attributed to the increasing demand from the textile industry and the rise in demand for personal care and cosmetics products. Acetic acid is widely used in these industries, which are having great demand in emerging economies like India and China.

Acetic Acid Market Segmentation

By Derivatives

- Vinyl Acetate Monomer (VAM)

- Purified Terephthalic Acid (PTA)

- Ethyl Acetate

- Acetic Anhydride

- Other Derivatives

By Application

- Plastics and Polymers

- Food and Beverage

- Adhesives, Paints, and Coatings

- Textile

- Medical

- Other Applications

By End-Use Industry

- Food and beverages

- Paints and coating

- Plastics & Polymers

- Pharmaceutical

- Chemicals

- Others

By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Vinyl Acetate Monomer (VAM): This segment is having a bigger share in the acetic acid market. It is made from acetic acid and is having high demand because of the increasing demand for cosmetics production and personal care products. It is also used in a variety of applications, such as paper adhesives & sealants, paints & coatings, and textiles.

Acetic Acid Market: Report Scope |

|

|

Base Year Market Size |

2021 |

|

Forecast Year Market Size |

2022-2032 |

|

CAGR Value |

5.3% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Regional Analysis:

Asia-Pacific holds the largest share of the acetic acid market. It is the largest market for adhesives, paints & coatings, food & beverages, and textile industries. Acetic acid is widely used in the applications such as polyesters, sealants, coatings, and greases. The growth in the industries, which have a large base in Asia-Pacific but also are the major industries for acetic acid, is the reason for market growth in the Asia-Pacific region for the acetic acid market. India, China, and Japan are the significant markets in this region.

Moreover, the North American market is expected to experience significant growth in the acetic acid market. Acetic acid production has increased in the region due to high demand from the meat industry. This has become the most important application sector in the region.

Acetic Acid Market Growth Drivers:

The textile market is the major driver of the acetic acid market. The rising demand for clothing and the rise in income levels of consumers lead to a rise in the acetic market. Various chemicals are used in textile manufacturing, and most of them consist of acetic acid. Moreover, the demand for vinyl acetate monomer is rising as there is a rise in cosmetics and industrial products. This will lead to a rise in the acetic acid market as it is used in bulk for the production of vinyl acetate monomer. Emerging economies, like Asia-Pacific, are expanding, which leads to an expansion of chemicals, textiles, and coatings. This will give rise to the acetic acid market as it is used widely in these industries.

Acetic Acid Market Challenges:

The raw materials required to produce acetic acid have variable costs, due to which there are changes in profit for alumina manufacturing. This is hindering their expansion plans and may cause a problem in market expansion. In addition, acetic acid is corrosive to human skin and eyes. It is very harmful to the organs as well if swallowed. This may act as a challenge for the users of acetic acid and may hamper the market growth.

Acetic Acid Market Key Companies:

- Celanese Corporation

- INEOS

- Jiangsu SOPO (Group) Co., Ltd.

- LynodellBasell Industries Holding B.V.

- SABIC

- Indian Oil Corporation Ltd

- Gujrat Narmada Valley Fertilizers & Chemicals Limited

- The Dow Chemical Product

- DAICEL CORPORATION

- Eastman Chemical Company

- Yankuang Group

- Other Players

The report profiles leading companies in the acetic acid market & its derivatives, such as Celanese Corporation, INEOS, Jiangsu SOPO (Group) Co. Ltd, and others.

In January 2023, Kingboard Holdings Limited announced that the company's unit, Hebei Kingboard Energy Development Co., Ltd., plans to submit the "Environmental Impact Report of Hebei Kingboard Energy Development Co., Ltd. Acetic Acid Expansion and Transformation Project" for approval and the entire content of the environmental impact study is accessible.

In June 2022, Hebei Kingboard Energy Development Co., Ltd. announced the opening of an acetic acid facility. The project was based on a carbon capture and recycling project to establish a high-value-added carbon neutrality demonstration park for innovative chemical materials and realize low-carbon development.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -