3D Printing High Performance Plastic Market Trend, Opportunity, and Forecast Analysis, 2024-2032

3D Printing High Performance Plastic Market

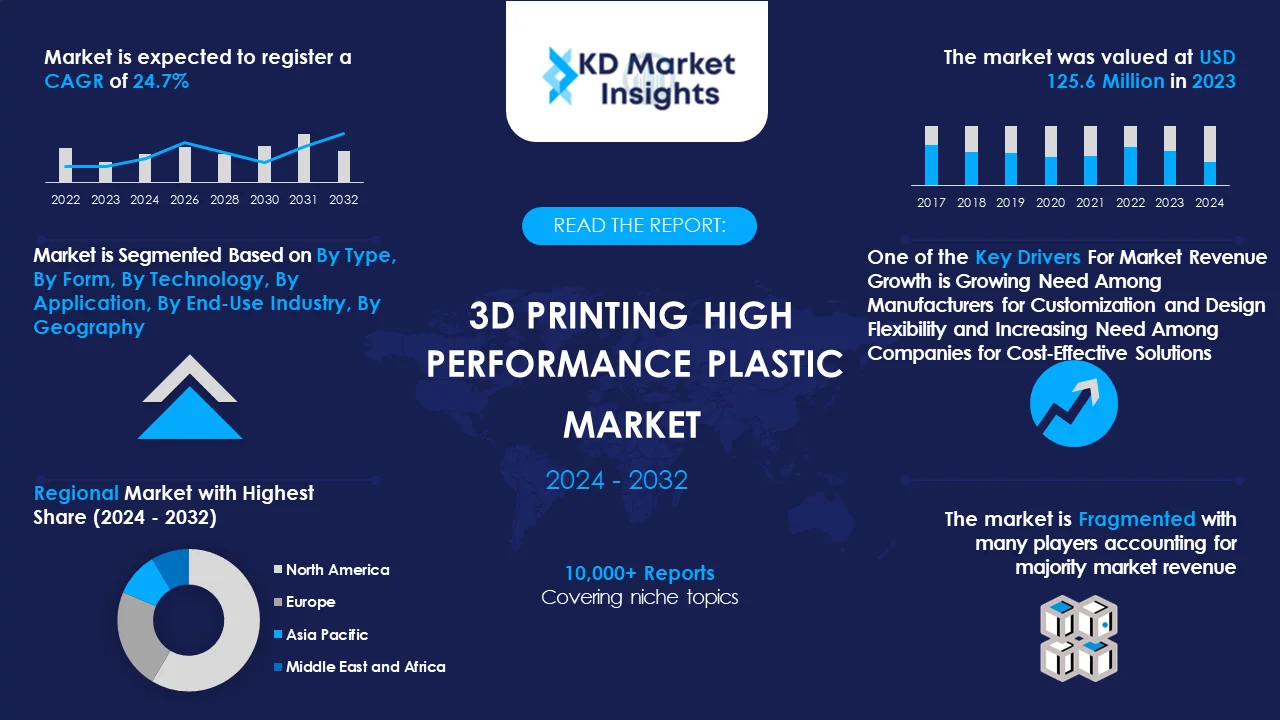

3D Printing High Performance Plastic Market is segmented by Type, Form, Technology, Application, End-Use Industry, and by Region. KDMI analyst’s growth analysis foresees market revenue to cross USD 395.3 Million by 2032 by growing with a CAGR of 24.7% during 2024-2032.

3D Printing High Performance Plastic Market Highlights

The global 3D printing high performance plastic market is expected to cross a market size of USD 395.3 million by the end of 2032. The market size was valued at USD 125.6 million in 2023 and is expected to expand at a CAGR of 24.7% between 2024-2032.

- Over the mid-term, the growing utilization of 3D printing across industries is the primary factor anticipated to drive the global 3D printing high performance plastic market.

- The high-cost of high-performance plastics is a major factor to challenge the market growth.

- The North America 3D printing high performance plastic market is projected to dominate the global market.

3D Printing High Performance Plastic Market: Report Scope |

|

|

Base Year |

2023 |

|

Base Year Market Size |

USD 125.6 Million |

|

Forecast Year |

2024-2032 |

|

Forecast Year Market Size |

USD 395.3 Million |

|

CAGR Value |

24.7% |

|

3D Printing High Performance Plastic Market Key Trends/Major Growth Drivers |

|

|

Restraint Factors |

|

|

3D Printing High Performance Plastic Market Segmentation |

|

|

3D Printing High Performance Plastic Market Key Players |

Stratasys Ltd., EOS GmbH, HP Inc., Arkema SA, Evonik Industries AG, BASF SE, 3D Systems Corporation, Carbon, Inc., Solvay SA, DSM NV, Victrex plc, SABIC (Saudi Basic Industries Corporation), and others. |

3D Printing High Performance Plastic Market Outlook

The class of advanced polymer materials that possesses exceptional mechanical, thermal, chemical, and electrical properties for 3D printing is known as high-performance plastics. These plastics have specifically engineered properties for which they are used to manufacture end-use parts and components.

According to our experts at KD Market Insights, one of the primary factors projected to drive the market growth is the growing utilization of 3D printing across industries. The companies around the globe are working towards discovering new ways to leverage 3D printing technology for prototyping, manufacturing, and customization of high-value components. Owing to the versatility of high-performance plastics that are used for 3D printing, business organizations are now able to utilize these plastics across various industries. Such a factor is hence expected to drive the demand for high-performance plastic filaments and powders, in turn, contributing to the growth of the 3D printing high performance plastics market. Stratasys Ltd., EOS GmbH, and HP Inc. are some of the significant parties in the global market for 3D printing high performance plastic.

Get More Insights on This Report - Request Free Sample PDF

Get More Insights on This Report - Request Free Sample PDF

3D Printing High Performance Plastic Market Drivers – Analyst’s Observation

According to the analysts at KD Market Insights, some key growth drivers for the global 3D printing high performance plastic market are:

- Growing Need Among Manufacturers for Customization and Design Flexibility: Manufacturers around the globe are increasingly facing several challenges while manufacturing intricate and complex designs. As 3D printing offers exceptional design flexibility, and upon that, high-performance plastics allow engineers and designers to create lightweight, durable, and precisely tailored components, the demand for these plastics among manufacturers around the globe is increasing. Such a factor is therefore expected to drive the market growth of 3D printing high-performance plastics.

- Increasing Need Among Companies for Cost-Effective Solutions: Companies worldwide are increasingly looking out for ways to lower their operational costs. Hence, manufacturers are embracing digital manufacturing ecosystems, supported by the Industry 4.0 and Industry 5.0 initiatives, that facilitates automation, connectivity, and remote operations. By integrating 3D printing technologies, companies take the benefits of digital design tools to produce on-demand products and components. Companies are also utilizing simulation software to develop 3D models before creating the final product. Additionally, remote operational processes that promote decentralized manufacturing and additive manufacturing workflows, allow businesses to create complex engineered products from anywhere around the globe. These advancements in 3D printing technologies, that lowers the cost of operations of businesses, is expected to raise the adoption of the technology among business organizations, and in turn, contribute to the demand for 3D printing high-performance plastics.

Which Probable Factors Could Hamper the Growing 3D Printing High Performance Plastic Market Trend?

As per our KD Market Insights analysis, some of the challenges expected to limit the global market growth of 3D printing high performance plastic are:

- High Cost of High-Performance Plastics: Due to the high-performance properties of plastics, these plastics are known to have elevated material costs when compared to traditional thermoplastics. Such high costs of the plastics is therefore expected to act as a barrier for the market growth.

- Numerous Challenges Associated with the Plastics: Several unique processing challenges and complexities have been experienced with the use of high-performance plastics, such as warping, delamination, and printability constraints among others, which is anticipated to limit the market expansion.

How is the Global 3D Printing High Performance Plastic Market Segmented?

Our experts at KD Market Insights have segmented the global 3D printing high performance plastic market research report as:

|

By Type |

|

|

By Form |

|

|

By Technology |

|

|

By Application |

|

|

By End-Use Industry |

|

|

By Region |

|

What are the Probable Factors Influencing the North America 3D Printing High Performance Plastic Market Forecast?

The North America 3D printing high performance plastic market is majorly driven by the growing advancement in material science and increasing innovations in polymer chemistry that result in the development of materials that possesses enhanced mechanical strength, thermal stability, and higher chemical resistance. In addition to this, increasing number of partnerships observed between material suppliers, 3D printer manufacturers, software developers, and end-users, along with the surge in awareness regarding the potential benefits of additive manufacturing technologies, are also projected to contribute to the market growth during the forecast period.

As per our analysts at KD Market Insights, the following five players lead the North America 3D printing high performance plastic market growth:

- Stratasys Ltd.

- 3D Systems Corporation

- Proto Labs, Inc.

- Carbon, Inc.

- HP Inc.

|

Key Countries to Watch for in North America 3D Printing High Performance Plastic Market |

Key Insights |

|

United States 3D Printing High Performance Plastic Market to Register the Largest Regional Market Share in 2032 |

USD 83.2 Million |

|

Canada 3D Printing High Performance Plastic Market to Grow with the Highest CAGR During 2024-2032 |

25.3% |

Which Key Players Top the Global 3D Printing High Performance Plastic Market Share?

As per our analysts at KD Market Insights, the competitive landscape of global 3D printing high performance plastic market facilitates our readers in identifying their closest competitors. The manufacturers who are associated with 3D printing high performance plastic market are raising their focus on expanding their presence, as well as their market share. The market has also been witnessing an upward movement in the number of collaborations between research institutions and key players, aimed at introducing advanced technologies and innovation of new products. Here is a list of the key players who top the global 3D printing high performance plastic market share:

- Stratasys Ltd.

- EOS GmbH

- HP Inc.

- Arkema SA

- Evonik Industries AG

- BASF SE

- 3D Systems Corporation

- Carbon, Inc.

- Solvay SA

- DSM NV

- Victrex plc

- SABIC (Saudi Basic Industries Corporation)

What are the Recent Developments Observed in the 3D Printing High Performance Plastic Market?

Over the years, the experts at KD Market Insights have been observing the recent developments associated with global 3D printing high performance plastic market trends. Our expert’s market forecast analysis has recorded the market players adopting plentiful of key strategies including new product launches, mergers & acquisitions, and collaborations.

For instance, Solvay stated that it has collaborated with Gingko Bioworks to develop sustainable biopolymers which would be used for 3D printing.

Further, Evonik shared that it, along with BellaSeno, entered into a partnership for commercializing Resomer polymers that would be used for medical applications.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -