3D PA Market - Global Size, Share, Trends, Growth and Forecast Year ( 2022 – 2032 )

3D PA Market By Type (Polyamide 11, Polyamide 12, and Others), Technology (Extrusion, Extrusion blow-molding, Injection molding, Rotomolding, and Others), End-Use Industry (Transportation, Optical Industry, Energy & Power, Electric & Electronic, Health Care, Energy, Oil & Gas, Wire & Cable, Consumer goods and Others), and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032

Market Size and Overview:

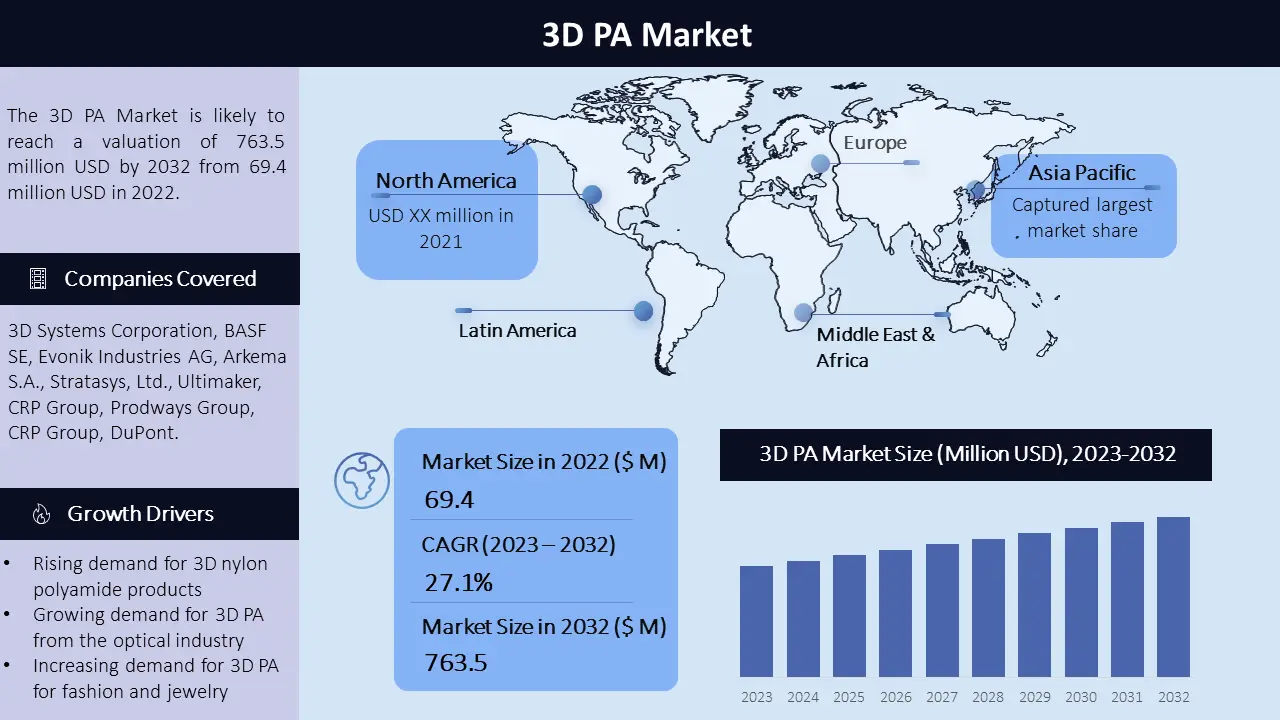

According to KD Market Insights, the 3D PA market has witnessed consistent expansion, achieving a market worth of USD 763.5 million by 2032, with a compound annual growth rate (CAGR) of 27.1% from 2023 to 2032. This growth can be attributed to the rising demand for 3D nylon polyamide products from various end-use industries using selective laser sintering technology. The market is divided into various segments like type, technology, end-use industry, and geographical regions.

|

3D PA Market Report Scope |

|

|

Base Year Market Size |

2022 USD 69.4 million

|

|

Forecast Year Market Size

|

2032 USD 763.5 million |

|

CAGR Value

|

27.1% from 2023 to 2032 |

|

Segmentation

|

•By type •By technology •By end-use industry •By geography

|

|

Challenges

|

•Environmental concerns •Stringent government regulations |

|

Growth Drivers

|

•Rising demand for 3D nylon polyamide products •Growing demand for 3D PA from the optical industry •Increasing demand for 3D PA for fashion and jewelry |

Market Segmentation:

By Type:

- Polyamide 11

- Polyamide 12

- Others

By Technology:

- Extrusion

- Extrusion blow-molding

- Injection molding

- Rotomolding

- Others

By End-Use Industry:

- Transportation

- Optical Industry

- Energy & Power

- Electric & Electronic

- Health Care

- Energy

- Oil & Gas

- Wire & Cable

- Consumer goods

- Others

Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Polyamide 12: Based on type, the polyamide 12 segment holds the largest share in the 3D Polyamide (PA) market. Polyamide 12 is a thermoplastic material that has the best impact strength and is less sensitive to stress cracking. In addition, it has a much lower melting point, density, and moisture absorption than other types of polyamide. It is used in a variety of industries like the automotive and electrical industry.

Transportation: Based on the end-use industry, the transportation segment holds the largest share in the 3D polyamide market. The demand is driven by the increase in demand for customized and prototype products of nylon polyamide using 3D printing selective laser sintering technology from various industries like automotive, marine, aerospace, and others.

Regional Analysis:

The regional analysis of the 3D PA Market reveals diverse trends and dynamics across different parts of the world. The Asia-Pacific region accounts for the largest share of the 3D polyamide market. This is because of the increasing demand from the end-use industries such as automotive, energy, aerospace, and others. The significant markets in the region are India, China, Indonesia, Japan, and South Korea.

North America is also a significant market for 3D Polyamide, with the United States being the largest market. The market is driven by the presence of major players in this region. The European market is also a key market for 3D Polyamide.

Growth Drivers:

The 3D PA market is driven by rising demand for 3D nylon polyamide products from various end-use industries using selective laser sintering technology. The growing demand for 3D PA from the optical industry because of its properties like flexibility and thin nature of fiber optic material, used in several types of products like display assembly, fiber optics, led assembly, photonics, camera module, and others in the area of both medicines as well as research. The growing demand for optical products will lead to an increase in demand for the 3D polyamide market.

As the properties of 3D polyamide offer flexibility, durability, and strength, it is widely used in fashion and jewelry. High-detail, custom jewelry is produced using 3D printing technology to be more precise using selective laser sintering technology. After polyester, polyamide fabric is the most widely used synthetic fabric. The increase in demand for fashion and jewelry will directly increase the demand for the 3D polyamide market.

Challenges:

The production of polyamide raises various environmental concerns that cause a threat to the 3D polyamide market. During the production, there is a release of various Volatile Organic Compounds (VOC) that causes pollution. Polyamide is a synthetic fabric, and it causes a huge negative impact on the environment as well as on human health. The workers working in the production of polyamide are exposed to various health issues like eyes, nose, and skin irritation. Due to this, strict government policies have been implemented on the production of polyamide. Hence, stringent government regulation also hampers the growth of the 3D polyamide market.

Key Companies:

- 3D Systems

- BASF SE

- Evonik Industries AG

- Arkema S.A.

- Stratasys, Ltd.

- Ultimaker

- CRP Group

- Prodways Group

- DuPont

- Polymaker Group

- EOS GmbH

- Others

The report profiles leading companies in the 3D PA Market, such as 3D Systems, BASF SE, Evonik Industries AG, and others. These companies have a strong market presence, extensive distribution networks, and a wide product portfolio. Their competitive strategies involve product innovation, strategic partnerships, mergers, and acquisitions to enhance their market share and cater to diverse customer needs.

In February 2022, Radici Group launched Radilon Adeline, a new line of filaments for 3D printing based on the Radilon PA6 polymers.

In January 2022, BASF SE is announced to expand its polyamide 6.6 production in Germany to increase its production capacity for 3D polyamide.

In June 2021, Arkema acquired 10% of French start-up Erpro 3D Factory, a company that specialized in large-series additive manufacturing and seeks to explore the potential of additive manufacturing technology for its materials.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -