2K Protective Coatings Market by Resin Type (Epoxy, Polyurethane, Alkyd, Acrylic, Others); By Application (Abrasion resistance, Chemical resistance, Fire protection, Heat resistance, Corrosion protection, Pipe coatings, Tank linings); End-user (Oil & Gas Exploration, Production, and Transmission, Petrochemical- Refineries and Chemical Processing, Marine, Cargo Containers, Power Generation, Water and Waste Treatment, Civil Building and Infrastructure, Food and Beverage Plants, Others); 2K Protective Coatings Market by Resin Type (Epoxy, Polyurethane, Alkyd, Acrylic, Others); By Application (Abrasion resistance, Chemical resistance, Fire protection, Heat resistance, Corrosion protection, Pipe coatings, Tank linings); End-user (Oil & Gas Exploration, Production, and Transmission, Petrochemical- Refineries and Chemical Processing, Marine, Cargo Containers, Power Generation, Water and Waste Treatment, Civil Building and Infrastructure, Food and Beverage Plants, Others); By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

2k Protective Coatings Market Market Size and Overview

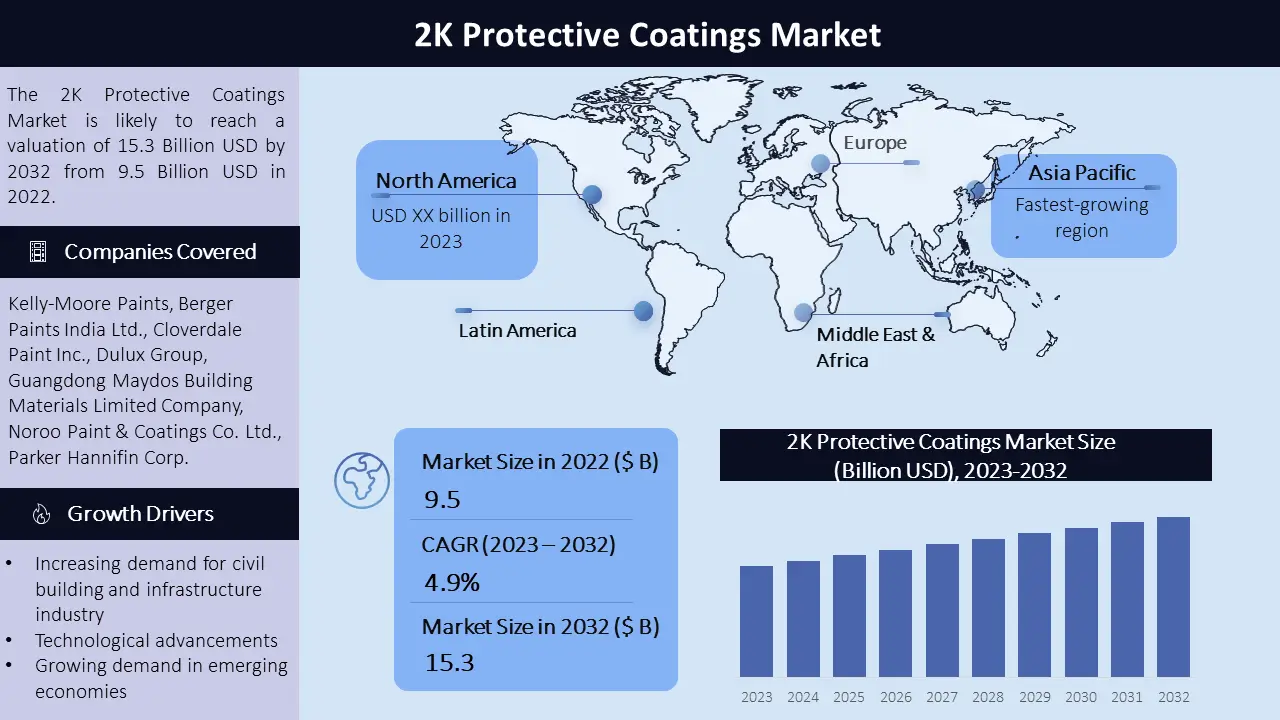

The 2K Protective Coatings Market has experienced steady growth, with a compound annual growth rate (CAGR) of 4.9% from 2023 to 2032, reaching a market value of USD 15.3 billion in 2032 (source: KD Market Insights). This growth can be attributed to the increasing demand for civil buildings and architectural infrastructure. The market is divided into different segments like resin type, end-users, applications, and geographical regions. The market is highly competitive, with key players continually innovating to meet evolving consumer demands.

2K Protective Coatings Market Report Scope |

|

|

Base Year Market Size |

2022 USD 9.5 billion

|

|

Forecast Year Market Size

|

2032 USD 15.3 billion |

|

CAGR Value

|

4.9% from 2023 to 2032 |

|

Segmentation

|

•By resin type •By application •By end-use industry •By geography

|

|

Challenges

|

•High cost of raw material •Stringent government policies

|

|

Growth Drivers

|

•Increasing demand for civil building and infrastructure industry •Technological advancements •Growing demand in emerging economies •Use in various applications |

2K Protective Coatings Market Market Segmentation

By Resin Type

- Epoxy

- Polyurethane

- Alkyd

- Acrylic

- Others

By Application

- Abrasion resistance

- Chemical resistance

- Fire protection

- Heat resistance

- Corrosion protection

- Pipe coatings

- Tank linings

By End-user

- Oil & Gas Exploration, Production, and Transmission

- Petrochemical- Refineries and Chemical Processing

- Marine

- Cargo Containers

- Power Generation

- Water and Waste Treatment

- Civil Building and Infrastructure

- Food and Beverage Plants

- Others

By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Polyurethane: Based on resin type, the polyurethane segment holds the largest share in the 2k protective coating market. Polyurethane is used in industrial and architectural coating systems as it is a hard-wearing and highly resistant coating. The marine industry has the largest demand for polyurethane as it provides durability and withstands harsh environments like salt water, pressure, and temperature.

Regional Analysis:

The regional analysis of the 2K Protective Coatings Market reveals diverse trends and dynamics across different parts of the world. The Asia-Pacific region accounts for the highest CAGR for the 2k protective coatings market. This is because of the increasing demand for coatings in the region with the availability of low-cost labor, cheap availability of land, and increasing demand from the marine industry. The market is driven by rapid industrialization, Marine sector growth, and increased demand from emerging economies. India and China are the significant markets of the region.

The North American market is also a significant market, with the United States and Canada as the most appropriate market for 2k protective coatings. The increasing construction spending and demand from the automotive and transportation sector are driving the market growth. The highly developed buildings and infrastructure industry, with the presence of key players, also positively affects the market growth. The increasing spending on research and development in the marine and construction sector creates new opportunities for the 2k protective coatings market.

2k Protective Coatings Market Growth Drivers

Several factors drive the growth of the 2K Protective Coatings Market. The market is driven by increasing demand for the civil building and infrastructure industry. This is because of the durability and high resistance to water and chemicals. It is used for steelwork, interior & exterior walls, paneling, and others in the architectural industry. It is ideal for coating surfaces as it is resistant to chemicals. It also has the ability required to withstand harsh weather conditions. It also attracts customers as it resists color fade and is paintable. Technological advancements are also taking place that is boosting the market growth.

2k Protective Coatings Market Challenges

The cost of the raw material for 2k protective coatings is expensive. The increase in crude oil prices and foreign currency leads to an increase in manufacturing costs for 2k protective coatings. Due to this, it poses a threat to the 2k protective coatings market. In addition, there are strict government policies regarding the use of 2k protective coatings, which makes it difficult for the manufacturers to develop the products. This hinders market growth.

2k Protective Coatings Market Key Players

- BASF

- Henkel Vorzuege

- Benjamin Moore

- Kelly-Moore Paints

- Berger Paints India Ltd.

- Cloverdale Paint Inc.

- Dulux Group

- Guangdong Maydos Building Materials Limited Company

- Noroo Paint & Coatings Co. Ltd.

- Parker Hannifin Corp

- Others

The report profiles leading companies in the 2K Protective Coatings Market, such as BASF, Henkel Vorzuege, Benjamin Moore, and others. These companies have a strong market presence, extensive distribution networks, and a wide product portfolio. Their competitive strategies involve product innovation, strategic partnerships, mergers, and acquisitions to enhance their market share and cater to diverse customer needs.

In October 2020, AkzoNobel expanded its production of powder coatings by investing a huge amount into the industry. This has been done to strengthen its market position and sharpen its focus on greener manufacturing.

In November 2020, PPG launched PPG AQUACOVER waterborne coating system for shipping containers in China. The product has high quality and offers the best anti-corrosion performance for shipping containers.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -