HDPE Pipes Market - By Product Type (PE 80, PE 100, PE 100RC and Others), Application (Oil & Gas Pipe, Agricultural Irrigation Pipe, Water Supply Pipe, Sewage System Pipe, and Others) & Regional Analysis - Market Size, Trends, Opportunity, Forecast 2023-2032

Global HDPE pipe market was held at USD 15,975.2 Million in 2022. The global HDPE pipe market is expected to flourish at a CAGR of 5.8% in the terms of value during the time period i.e. 2023-2032. The rise in agricultural and industrial activities and demand for pipeline infrastructure is increasing in oil & gas exploration and production activities are anticipated to drive the growth of the global HDPE pipes market over the upcoming years.

Market Dynamics

Growth Drivers – HDPE pipe Market

Aging Water Infrastructure

The HDPE (High-Density Polyethylene) pipes are used as a medium for supplying drinking water. Various countries in America are facing the problem with the water which is affecting the individual household and communities. In the past few months, the United States Environmental Protection Agency (EPA) also announced the availability of more than USD 95 Million in new funds to help the State of Michigan, such government initiatives to improve the drinking water and wastewater infrastructure is expected to drive the growth of HDPE pipes market in the North America region. The United States totally depends upon the underground pipes for their water supply, but the network of these underground pipes has reached the end of their useful life, which is resulting in various health problems. Further, increasing spending on the water infrastructure and wastewater treatment is believed to impetus the growth of the HDPE pipes market over the upcoming years.

Sewage Disposal Infrastructure

Due to the continuous infrastructure development of sewage systems in the developing countries, the demand for plastic pipes has increased exponentially, on the back of which the demand for high-density polyethylene (HDPE) pipes is also increasing. The HDPE pipes offer various functional advantages such as sustainability, durability, and flexibility along with superior resistance to corrosion and abrasion which are needed in the sewage water treatment. Apart from this, the HDPE piping systems also provide long service life, excellent joint performance, and offer leak-free protection. Further, the growth of the sewage disposal infrastructure is anticipated to positively impact the growth of HDPE pipes market.

HDPE Pipes in Oil & Gas Industry

In the oil & gas industry, the companies are trying to adopt high-density polyethylene (HDPE) pipes as an alternative of steel pipes due to the cost-effectiveness of the HDPE pipes. Also, the HDPE pipes offer advantages such as chemical and corrosion resistance, lightweight and these pipes also can be used in moderate temperatures. Apart from this, in the oil & gas industry, the high-density polyethylene (HDPE) pipes are also used in the fracking (a process of injecting liquid at high pressure) for the collection and transportation of hydrocarbons, as well as the transportation and collection of water which is used in this process. The major reason behind using the HDPE pipes in this process is its excellent impact resistance, high tensile strength, low moisture absorption, and ease-of-handling. Further, these advantages are increasing the use of HDPE pipes in the oil & gas industry which is expected to drive the growth of the HDPE pipes market over the forecast period.

Barriers – HDPE pipe Market

Higher Cost of HDPE Pipes

The major constraint in the growth of the HDPE pipes market is the higher cost of these pipes. The high-density polyethylene (HDPE) pipes are 25% more expensive when they are compared with the PVC pipes. Also, the installation cost of the high-density polyethylene (HDPE) pipes is comparatively high in comparison with the other plastic pipes. The installation cost of HDPE pipes varies around 2% to 3% to the cost of the other plastic pipes. Further, this variation in the pricing of the plastic pipes is expected to hamper the growth of the HDPE pipes market.

Fluctuation in the Price of Raw Material

High-density polyethylene (HDPE) pipes are made from the polymerization of ethylene which is obtained from oil. The cost of raw materials used in the manufacturing of high-density polyethylene (HDPE) pipes remains highly volatile and fluctuating with time. This fluctuation in raw material prices may obstruct the growth of High-density polyethylene (HDPE) pipes market in future.

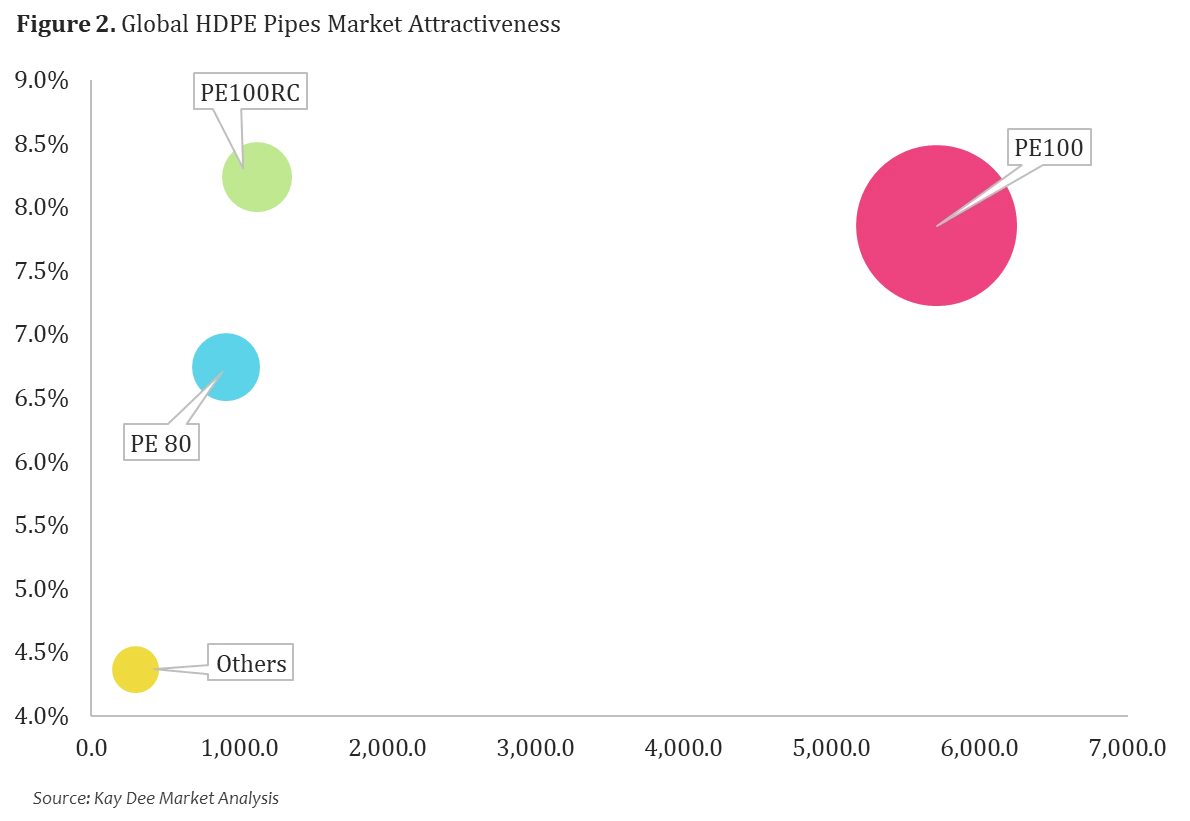

Segmentation Analysis

The market is segmented by product type into PE80, PE100, PE100RC, and others, out of which, PE 100 segment shared approximately 67.7% of the global HDPE pipes market in 2022. It was followed by PE 80 segment in terms of market share in 2022. Rapid urbanization is anticipated to increase the demand for water supply, leading to an increase in the requirement of HDPE pipes. Furthermore, growth in sewage disposal infrastructure and increasing application of HDPE pipes in various end-use industries is expected to drive the demand for HDPE pipes in the future.

In the application segment, the HDPE pipe market is sub-segmented into oil & gas Pipe, agricultural irrigation pipe, water supply pipe, sewage system pipe, and others.

Geographical Analysis

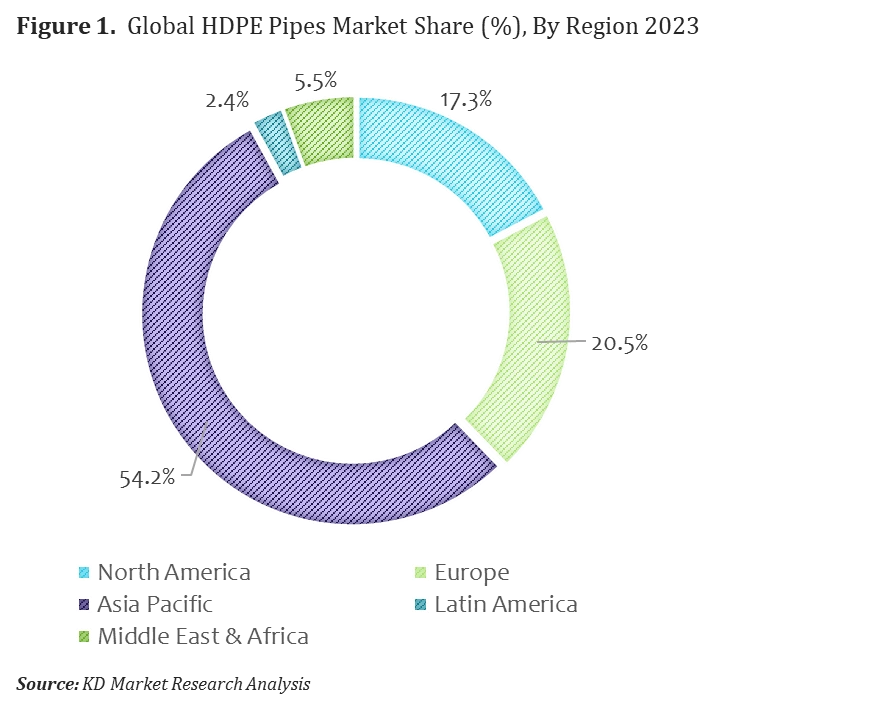

In terms of geography, the high-density polyethylene (HDPE) pipes market can be segregated into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific accounts for the major share of the global High-density polyethylene (HDPE) pipes market.

Asia Pacific HDPE pipes market is anticipated to reach USD 12,988.8 Million by the end of 2024. Asia Pacific HDPE pipes market is expected to stand at a market share of 56.5% by the end of 2024.

Competitive Analysis

The report also covers detailed competitive analysis of major market players of the global HDPE pipe market, such as JM Eagle Inc., WL Plastics, POLYPLASTIC Group, Lane Enterprises, Inc., Prinsco, Inc., Uponor Oyj, Mexichem, United Poly Systems, Blue Diamond Industries, LLC and Radius Systems Ltd. The HDPE pipe market is witnessing a wide range of industry activities such as acquisition, mergers, and expansion across the globe. For instance, Core & Main LP, a U.S. distributor of water, sewer and fire protection products, acquired select assets of Maskell Pipe & Supply, Inc., a California-based distributor and fittings fabricator of high-density polyethylene (HDPE) pipe.

Segmentation

By Product Type

- PE80

- PE100

- PE100RC

- Others

By Application

- Oil & Gas Pipe

- Agricultural Irrigation Pipe

- Water Supply Pipe

- Sewage System Pipe

- Others

By Geography

- North America (U.S. & Canada)

- Europe (Germany, United Kingdom, France, Italy, Spain, Russia and Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Indonesia, Taiwan, Australia, New Zealand and Rest of Asia Pacific)

- Latin America (Brazil, Mexico, Argentina and Rest of Latin America)

- Middle East & Africa (GCC, North Africa, South Africa and Rest of Middle East & Africa)

Competitive Landscape

The report profiles various major market players such as

- JM Eagle Inc.

- WL Plastics

- POLYPLASTIC Group

- Lane Enterprises, Inc.

- Prinsco, Inc.

- Uponor Oyj

- Mexichem

- United Poly Systems

- Blue Diamond Industries, LLC

- Radius Systems Ltd.

- Other Major & Niche Players

Competitive landscape analysis provides detailed strategic analysis of the company’s business and performance such as financial information, revenue breakup by segment and by geography, SWOT Analysis, key facts, company overview, business strategy, key product offerings, marketing and distribution strategies, new product development, recent news (acquisition, expansion, technology development, research & development and other market activities).

The study also provides company’s positioning and market share in HDPE pipe market.

Timeline Considered for Analysis:

- 2022: Base Year

- 2023: Estimated Year

- 2023 to 2032: Forecast Period

Research Scope and Deliverables

Overview & Executive Summary

Market Drivers, Trends, Challenges and Opportunities

Market Size and Forecast Projections

Macroeconomic Indicators of Various Countries Impacting the Growth of the Market

Extensive Coverage of Industry Players including Recent Product Launches and Market Activities

Porter’s Five Force Analysis

Market Segmentation Analysis:

Industry report analyzes the global HDPE pipe market by the following segments:

- Product Type

- Application

Customization: We also offers customization’s in the industry report as per the company’s specific needs.

|

Attribute |

Details |

|

Market Size Projection |

USD 15,975.2 Million in 2022, CAGR: 5.8% (2023-2032) |

|

Growth Drivers |

Rise in agricultural and industrial activities; Demand for pipeline infrastructure in oil & gas sector; Aging water infrastructure and sewage disposal projects |

|

Market Dynamics |

Increasing demand for HDPE pipes in water supply, sewage, and oil & gas sectors; Adoption of HDPE pipes in oil & gas industry |

|

Market Challenges |

Higher cost of HDPE pipes compared to alternatives; Fluctuations in the price of raw materials |

|

Segmentation Analysis |

PE 100 segment holds 67.7% of the market share in 2022 |

|

Application segments: Oil & Gas, Agricultural Irrigation, Water Supply, Sewage |

|

|

Geographical Analysis |

Asia Pacific holds major share with CAGR of 10.5% (2023-2024) |

1 Preface

1.1 Research Methodology

1.2 Geographic Scope

1.3 Years Considered

2 Executive Summary

3 Market Overview

3.1 HDPE Pipes Overview

3.2 Market Definition & Key Market Segments

3.3 Industry Development

3.4 Global Market Maturity

3.4.1 North America

3.4.2 Europe

3.4.3 Asia Pacific

3.4.4 Latin America

3.4.5 Middle East & Africa

3.5 Porter’s Five Force Analysis

3.6 Industry Value Chain Analysis

3.7 Macro-Economic Trends

4 Competitive Landscape

4.1 Global HDPE Pipes Market 2017

4.2 Global HDPE Pipes Market Value Share, By Company 2017

4.3 Global HDPE Pipes Market Volume Share, By Company 2017

5 Growth Drivers & Barriers in Global HDPE Pipes Market

5.1 North America

5.2 Europe

5.3 Asia Pacific

5.4 Rest of World

6 Trends in Global HDPE Pipes Market

6.1 North America

6.2 Europe

6.3 Asia Pacific

6.4 Rest of World

7 Global HDPE Pipes Market

7.1 Introduction

7.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

7.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

8 Global HDPE Pipes Market Segmentation Analysis, By Product Type

8.1 Introduction

8.2 Strategic Insights

8.3 BPS Analysis, By Product Type

8.4 Market Attractiveness, By Product Type

8.5 PE 63 Market

8.5.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

8.5.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

8.6 PE 80 Market

8.6.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

8.6.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

8.7 PE 100 Market

8.7.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

8.7.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

8.8 PE 100RC Market

8.8.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

8.8.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

8.9 Others Market

8.9.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

8.9.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

9 Global HDPE Pipes Market Segmentation Analysis, By Application

9.1 8.1. Introduction

9.2 8.2. Strategic Insights

9.3 BPS Analysis, By Application

9.4 Market Attractiveness, By Application

9.5 Oil & Gas Pipe Market

9.5.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

9.5.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

9.6 Agricultural Irrigation Pipe Market

9.6.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

9.6.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

9.7 Water Supply Pipe Market

9.7.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

9.7.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

9.8 Sewage System Pipe Market

9.8.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

9.8.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

9.9 Others Market

9.9.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

9.9.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

10 Geographical Analysis

10.1 Introduction

10.2 North America HDPE Pipes Market

10.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

10.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

10.3 By Product Type

10.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

10.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

10.4 By Application

10.4.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

10.4.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

11 Europe HDPE Pipes Market

11.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

11.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

11.2 By Product Type

11.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

11.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

11.3 By Application

11.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

11.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

12 Asia Pacific HDPE Pipes Market

12.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

12.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

12.2 By Product Type

12.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

12.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

12.3 By Application

12.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

12.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

13 Latin America HDPE Pipes Market

13.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

13.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

13.2 By Product Type

13.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

13.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

13.3 By Application

13.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

13.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

14 Middle East & Africa HDPE Pipes Market

14.1.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

14.1.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

14.2 By Product Type

14.2.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

14.2.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

14.3 By Application

14.3.1 Historical Market Value (USD Million) 2015-2017, Market Value Forecast & Y-o-Y Growth Analysis, 2019-2025

14.3.2 Historical Market Volume (Thousand Tons) 2015-2017, Market Volume Forecast & Y-o-Y Growth Analysis, 2019-2025

15 Competitive Landscape

15.1 Market Share of Key Players in HDPE Pipes Market

15.2 HDPE Pipes Company Analysis

15.3 JM Eagle, Inc.

15.4 Company Overview

15.4.1 Product Offered

15.4.2 Business Strategy

15.4.3 Financials

15.4.4 SWOT Analysis

15.4.5 Market Share Analysis

15.4.6 Key Achievements & Developments

15.5 WL Plastics

15.6 POLYPLASTIC Group

15.7 Lane Enterprises, Inc.

15.8 Prinsco, Inc.

15.9 Uponor Oyj

15.10 Mexichem

15.11 United Poly Systems

15.12 Blue Diamond Industries, LLC

15.13 Radius Systems Ltd.

15.14 Other Prominent Players

16 Disclaimer

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -